AI-native asset management

AI Crypto Investing

Autonomous financial agents that learn, adapt, and outperform. No human input required.

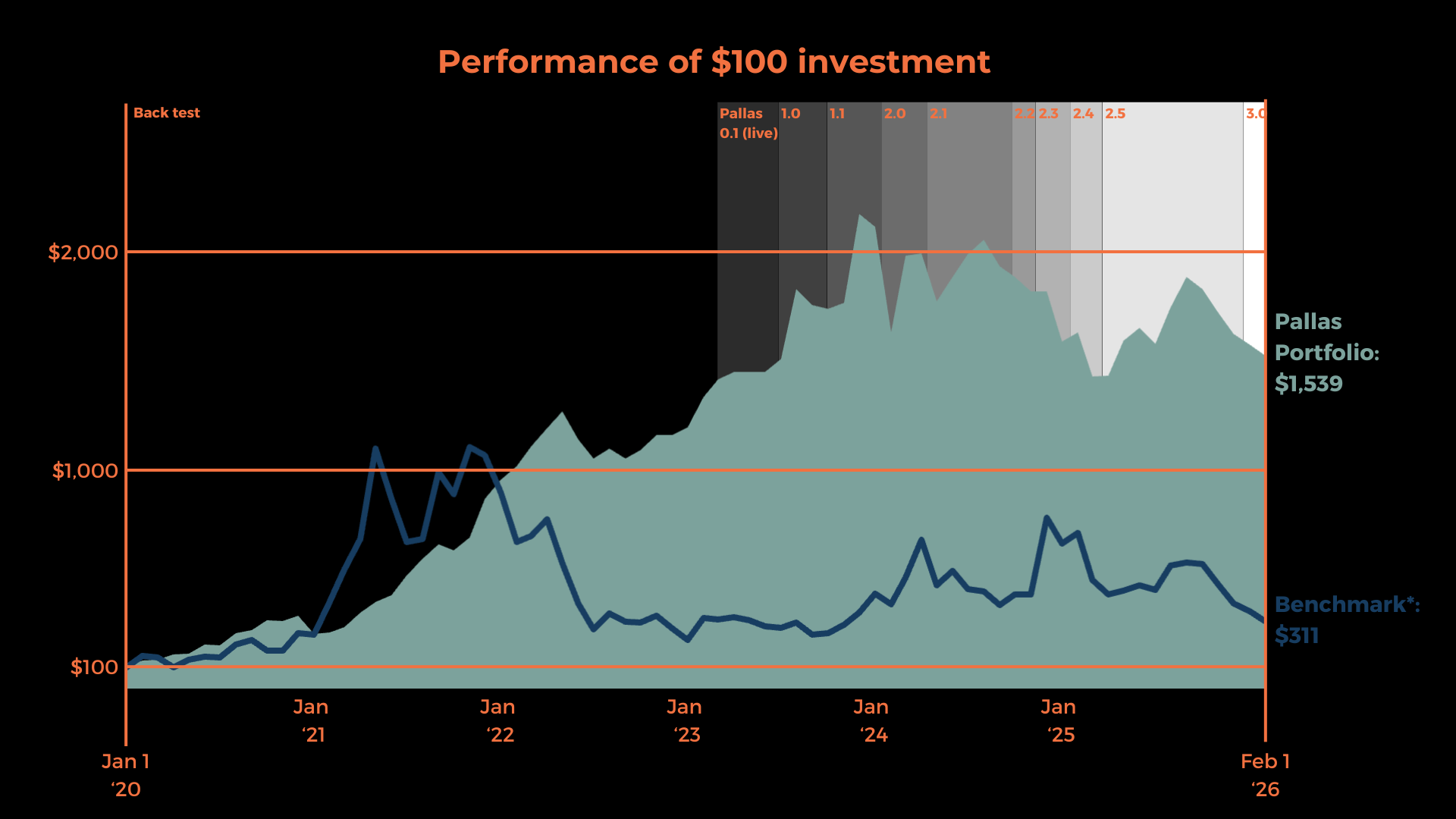

The Pallas Portfolio

Long-only, systematic crypto market timing strategy. Reinforcement learning to achieve large information ratio (i.e., large alpha above benchmark with low risk).

-

Pallas Portfolio: 46%

Bitcoin: 33%

(Measured over previous 5 years.)

-

Pallas Portfolio: 20%

Bitcoin: 48%

(Measured over previous 5 years)

-

Pallas Portfolio: 2.2

Bitcoin: 0.6

(Measured over previous 5 years.)

-

Pallas Portfolio: 2.4

Bitcoin: 0.5

(Measured over previous 5 years.)

-

Pallas Portfolio: +28%

Bitcoin: -9%

(Evaluated using the Capital Asset Pricing Model for the crypto market. Measured over previous 5 years.)

-

Pallas Portfolio: 0.2

Bitcoin: 0.9

(Evaluated using the Capital Asset Pricing Model for the crypto market. Measured over previous 5 years.)

(Last updated: February 1, 2026)

(*: The benchmark is a passive basket of the same coins in the investment universe of the Pallas Portfolio, equally-weighted and rebalanced daily.)

Join our community

Stay up-to-date on the latest crypto market developments by joining our mailing list.