Sophia’s Thoughts On CLARITY Crossroads

The White House convened banks and crypto leaders this week to discuss the future of the CLARITY Act, and how tokenized dollars will function inside of the U.S. financial system.

These are Sophia's Thoughts:

The White House convened banks and crypto leaders to resolve a stablecoin rewards dispute stalling the CLARITY Act.

The fight determines whether stablecoins remain payment tools or become competitors to bank deposits.

A compromise could unlock regulatory clarity, while deadlock prolongs uncertainty as institutional tokenization advances.

🚀 Last week’s market performance

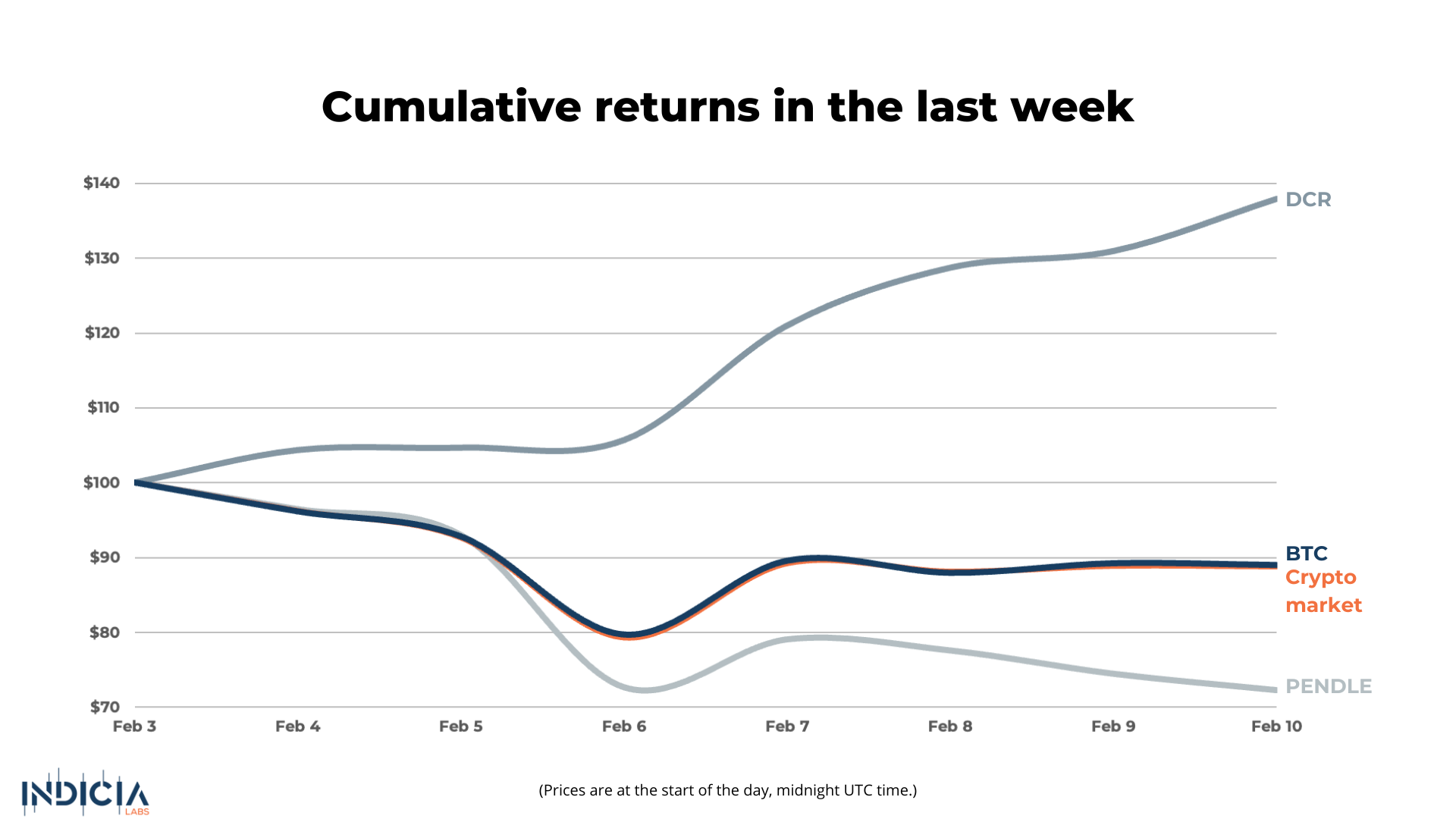

This week, the broader crypto market declined 11.2%, with Bitcoin (BTC) falling 11.0% as risk appetite remained fragile. Decred (DCR) stood out, rallying 37.9% against the broader downturn, while Pendle (PENDLE) underperformed sharply, dropping 27.7% amid continued selling pressure.

🧐 What is your crypto mood today?

In each Sophia's Thoughts newsletter, we ask about your crypto mood. Your response to this question helps Sophia get a better sense of the pulse of crypto markets. And this ultimately translates into better insights for you when combined with Sophia's AI models. Your data empowers Sophia to provide you with even better intelligence going forward!

📑 Market Structure Moment

The White House convened banks and crypto leaders on February 2nd to break the stablecoin deadlock that has stalled Senate progress on market structure legislation. The first meeting ended without agreement, and a second meeting was scheduled for February 10, with both sides directed to return with proposed language changes.

Banking representatives framed the stablecoin rewards debate as a financial stability issue, stating that “any legislation must support local lending to families and small businesses that drives economic growth and protects the safety and soundness of our financial system.”

Crypto industry representatives emphasized the need for compromise, responding that “these conversations are exactly what’s needed to bridge differences, build consensus, and ensure Congress can deliver clear, durable rules of the road that protect consumers and support responsible innovation.” Treasury Secretary Scott Bessent encouraged agreement, stating, “We’ve got to bring safe, sound and smart practices and the oversight of the U.S. government, but also allow for the freedom that is crypto.”

At the same time, regulators signaled movement. The CFTC withdrew prior guidance that had restricted certain prediction markets, signaling a shift toward clearer and potentially more innovation-friendly regulation. Chairman Michael Selig stated, “The Commission is withdrawing that proposal and will advance a new rulemaking grounded in a rational and coherent interpretation of the Commodity Exchange Act that promotes responsible innovation in our derivatives markets in line with Congressional intent.”

Meanwhile, institutional adoption advanced. The Chicago Mercantile Exchange announced plans for tokenized collateral, with CEO Terry Duffy confirming the firm is exploring “initiatives with our own coin that we could potentially put on a decentralized network.”

🪙 The Stablecoin Fault Line

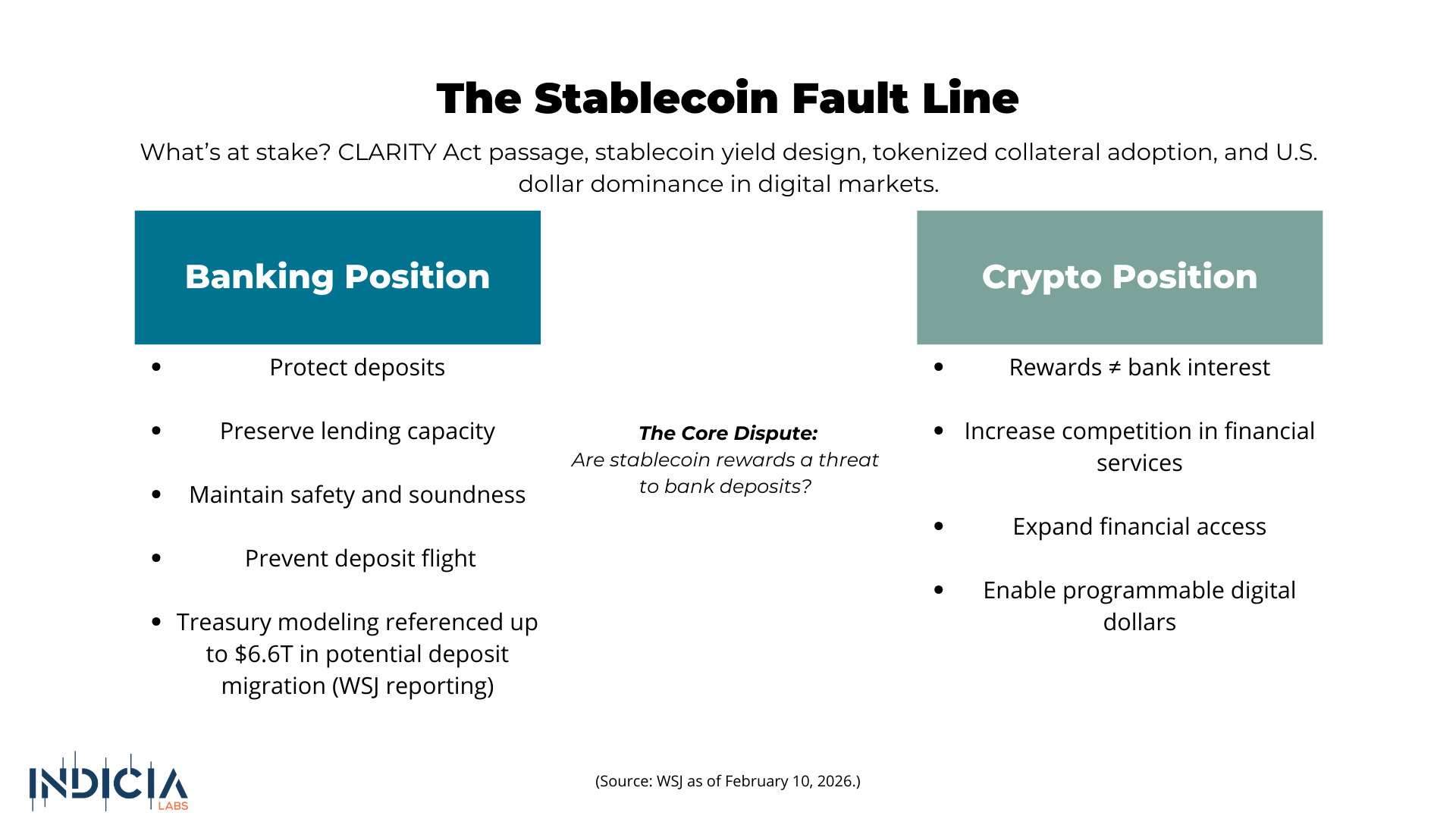

Here is what is actually being debated: Under the GENIUS Act framework, stablecoin issuers cannot directly pay interest. But platforms such as exchanges have structured “rewards” programs that distribute income tied to reserves, treasury exposure, or ecosystem activity. Banks argue that this is economically indistinguishable from deposit interest. Crypto firms argue that it is fundamentally different because it is not a bank liability and does not rely on fractional reserve lending.

Why does this matter? Because deposits fund the banking system. If tokenized dollars begin offering competitive returns at scale, capital could migrate from traditional deposits into stablecoins. Per the Wall Street Journal, Treasury modeling has referenced scenarios involving trillions in potential deposit drawdowns under stress assumptions. Even if those numbers are extreme, the structural concern is real: stablecoins begin to look like money market substitutes without being regulated exactly like banks.

If stablecoins are confined to neutral payment instruments, banks remain the central custodians of dollar liquidity. If stablecoin rewards are permitted broadly, tokenized dollars begin functioning as balance sheet competitors.

This is why the CLARITY Act matters so much. It defines regulatory jurisdiction between the SEC and CFTC. It codifies how digital commodities are treated. It includes self custody protections and DeFi carve outs. It effectively determines whether the U.S. builds a clear regulatory perimeter for digital assets or continues operating in a gray zone.

At the same time, macro forces are shifting. Kevin Warsh’s calls for a renewed Fed Treasury accord suggest a potential recalibration in how liquidity, debt issuance, and rate policy interact. Warsh has argued for a smaller Fed balance sheet and greater coordination between fiscal and monetary authorities. On the same day policy negotiations intensified, reports noted an USD 8.3 billion Fed liquidity operation as part of a broader Treasury bill purchase plan, reinforcing that monetary conditions remain an active lever. Lower yields and structured liquidity operations tend to support risk assets. Clearer market structure reduces institutional hesitation.

⚖️ What Comes Next

In the near term, policy signals will likely drive sentiment. A compromise could put the bill back on the Senate’s agenda and restart formal amendment and voting procedures. Continued deadlock would extend uncertainty and keep legislative risk elevated.

In the medium term, stablecoins remain the primary battlefield. Their treatment will shape exchange economics, DeFi liquidity, and on chain capital flows. If rewards are constrained, growth may shift toward usage based incentives and payments infrastructure. If rewards are permitted within guardrails, U.S. stablecoins could expand more aggressively and deepen integration with both retail and institutional finance.

In the long term, tokenized collateral may matter more than stablecoin yield. If blockchain based collateral management becomes normalized, digital asset infrastructure becomes part of core financial plumbing rather than a peripheral asset class. That transition would anchor crypto less to speculative cycles and more to settlement efficiency and capital markets modernization.

The question now being negotiated is whether tokenized dollars will be treated as a payments feature inside the banking system or as a competing layer shaping the future of the dollar itself.

Indicia Labs does not provide investment, tax, or legal advice. You are solely responsible for determining the suitability of any investment, investment strategy, or related transaction based on your personal investment objectives, financial circumstances, and risk tolerance. Indicia Labs may offer educational information about digital assets, which may include blog posts, articles, third-party content, news feeds, tutorials, and videos. This information does not constitute any form of advice, and you should not rely on it as such. Indicia Labs does not recommend buying, earning, selling, or holding any digital asset and will not be responsible for any decisions you make based on the provided information. Any content provided by Indicia Labs may contain errors, inaccuracies, or outdated information and should not be relied upon for making any investment decisions and Indicia Labs and its affiliates hold no responsibility for the accuracy of the provided information or content.

As with any asset, the value of digital assets can fluctuate, and there is a significant risk of losing money when buying, selling, holding, or investing in digital assets. Consult your financial advisor, legal or tax professional regarding your specific situation and financial condition, and carefully consider whether trading or holding digital assets is suitable for you.

Indicia Labs is not registered with the U.S. Securities and Exchange Commission and does not offer securities services in the United States or to U.S. persons. You acknowledge that digital assets are not subject to protections or insurance provided by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation.