Sophia’s Thoughts On A Market Under Strain

Markets were forced into a rapid repricing as crowded positioning, policy uncertainty, and thin liquidity collided, even without a true breakdown in underlying fundamentals.

These are Sophia's Thoughts:

The weekend sell-off was triggered by a convergence of stretched positioning, elevated leverage, and a sudden liquidity drain from a partial U.S. government shutdown tied to unresolved Homeland Security funding negotiations.

The nomination of Kevin Warsh as the next Fed Chair forced markets to reprice assumptions around interest rates and policy frameworks, amplifying risk-off behavior.

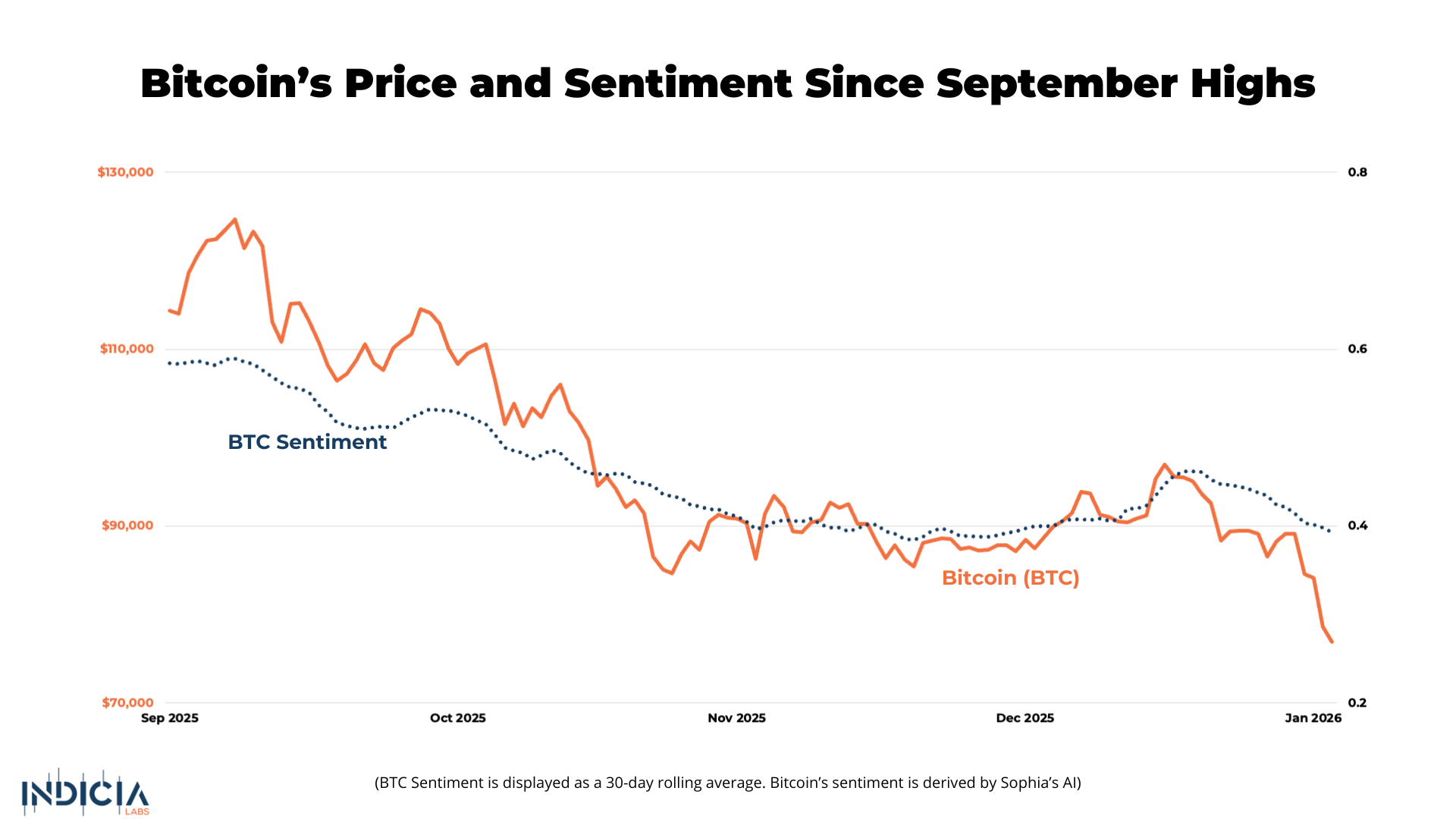

With forced liquidations flushing leverage and sentiment hitting extreme fear, markets now turn to liquidity conditions, Fed signaling, and ETF flows to determine whether this move marks a reset or a deeper unwind.

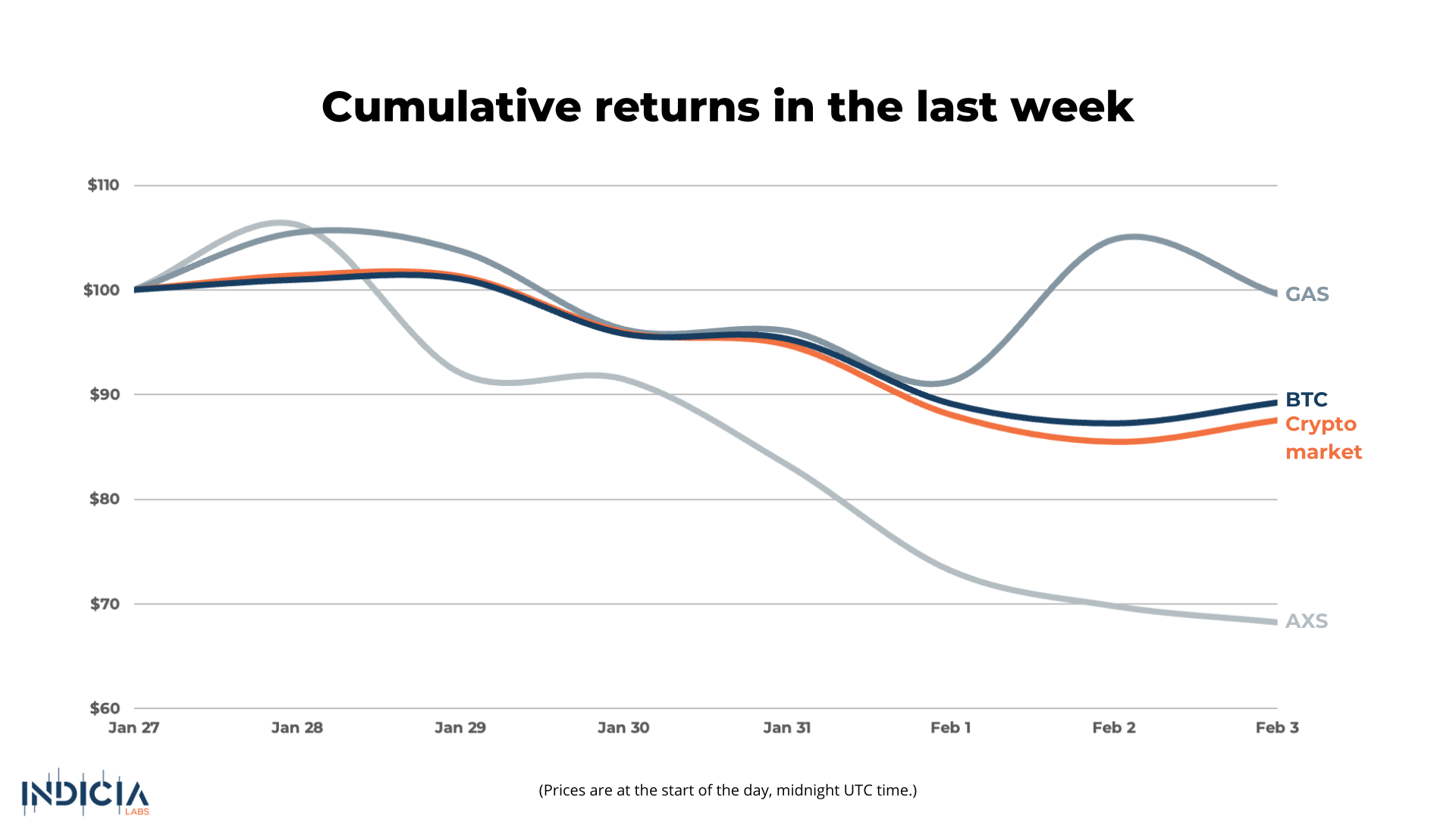

🚀 Last week’s market performance

In each Sophia's Thoughts newsletter, we ask about your crypto mood. Your response to this question helps Sophia get a better sense of the pulse of crypto markets. And this ultimately translates into better insights for you when combined with Sophia's AI models. Your data empowers Sophia to provide you with even better intelligence going forward!

🌊 A Fragile Market

The weekend sell-off, where Bitcoin fell from over USD 84,000 to near USD 74,000, was not the result of a single shock, but the release of pressure that had been building for weeks in an increasingly fragile market. Positioning across crypto and other risk assets was stretched, leverage remained elevated, and liquidity was unusually thin heading into the weekend. When several sources of uncertainty hit at once, there was little depth to absorb selling.

One of those stressors was a partial U.S. government shutdown, which began Saturday after Congress failed to finalize funding for the Department of Homeland Security. While lawmakers had already passed spending bills covering most of the federal government, negotiations broke down over immigration enforcement provisions tied to ICE, leaving DHS unfunded and triggering a lapse in appropriations. Markets were forced to price the risk of a prolonged political standoff before a deal was reached early Tuesday.

As Schwab noted in their market update, a shutdown “limits government purchases and government payrolls, and sops up liquidity,” a dynamic that has historically weighed on risk assets during funding disruptions. That prospective liquidity drain arrived just as markets were already on edge from geopolitical developments and shifting Federal Reserve leadership expectations.

Once Bitcoin slipped below key technical levels near USD 81,000, the move quickly became mechanical. More than USD 2.5 billion in crypto positions were liquidated over the weekend, mostly longs, triggering forced selling that fed on itself. Reuters observed that the cascade highlighted “how sensitive the crypto market has become to risk-off sentiment,” particularly when macro uncertainty collides with thin trading conditions.

This dynamic extended well beyond crypto. Precious metals suffered historic declines, AI-linked equities sold off sharply, and private-equity stocks fell in tandem. As David Morrison of Trade Nation said to Reuters, “Investors were looking for an excuse to lighten up and they finally got several.” In short, this was a broad risk-off event driven by liquidity stress and policy uncertainty, not a judgment on crypto’s underlying fundamentals.

🏦 Warsh, Interest Rates, and a Shift in the Fed’s Framework

A major catalyst for the repricing was the nomination of Kevin Warsh as the next Federal Reserve Chair. Markets did not react because Warsh is expected to raise rates imminently, but because his views challenge the Fed’s existing framework for how inflation works.

Warsh has argued that inflation arises when “the government prints too much, spends too much, and lives too well,” a view that places fiscal dominance and monetary excess at the center of the problem. More recently, he has been outspoken about the Fed’s failure to incorporate technological change into its models, saying the central bank is “stuck in 1978… unable to see the productivity miracle and instead treating growth as inflationary,”

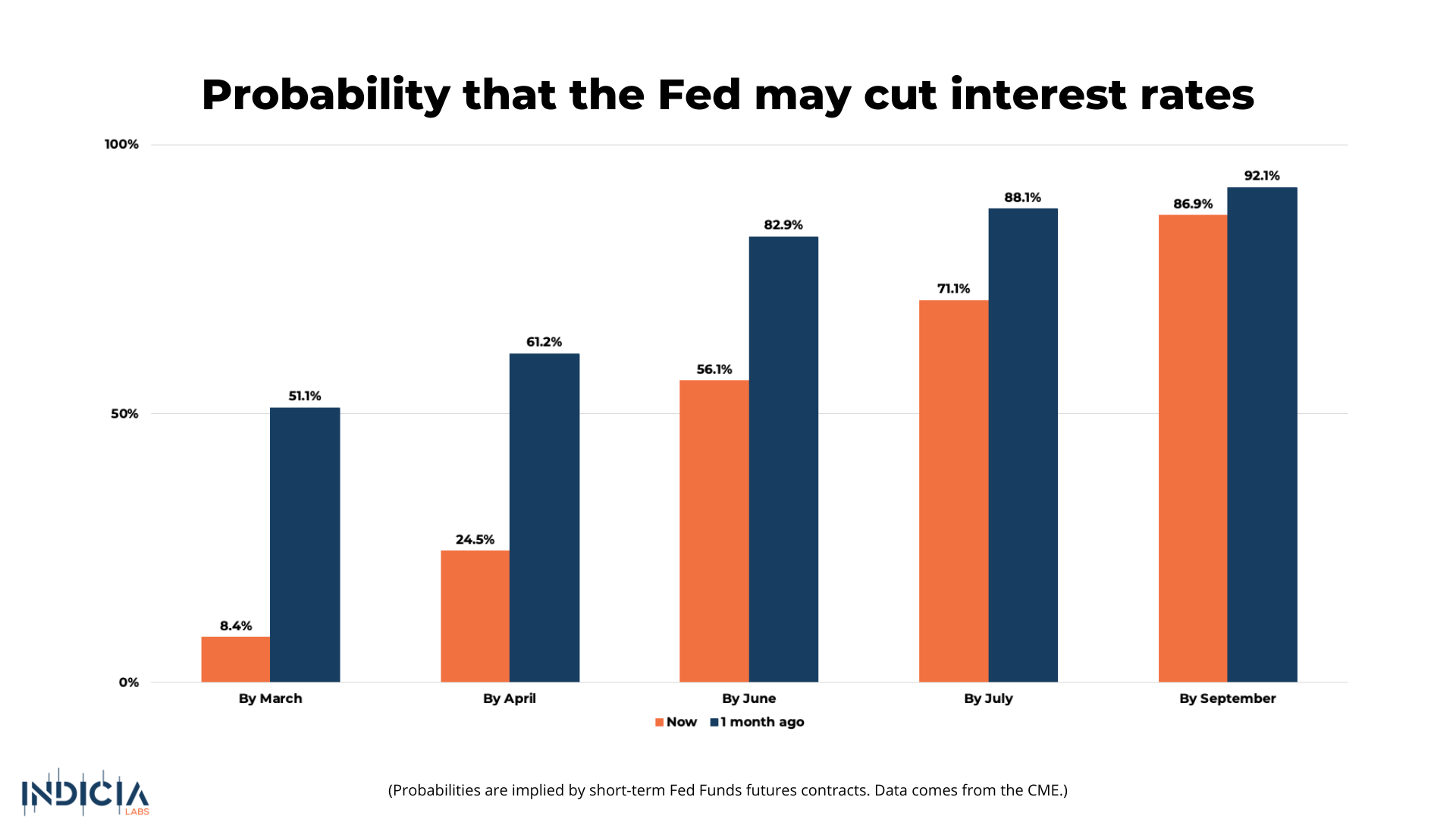

This matters because Warsh views artificial intelligence as structurally deflationary. That perspective introduces uncertainty around how future data will be interpreted, particularly if growth remains strong while inflation continues to cool. Importantly, markets have not treated Warsh’s nomination as overtly hawkish. Interest-rate futures modestly increased the probability of cuts in 2026 following the announcement. As Stanley Druckenmiller said on the day of the nomination, “The branding of Kevin as someone who’s always hawkish is not correct. Kevin right now very much believes you can have growth without inflation.”

Still, the immediate reaction across gold, silver, and crypto reflected concern not about higher rates, but about tighter liquidity and the possibility of a more aggressive stance on the Fed’s balance sheet.

⚖️ Liquidity, Governance, and What Comes Next for Crypto

The sharp reaction also reflects uncertainty about how much power Warsh will actually have once in the chair. The Federal Reserve remains a committee-driven institution, and interest-rate decisions require consensus among the 12 voting members of the FOMC. Whether policy can shift meaningfully toward faster or deeper rate cuts depends on who ultimately occupies those seats.

As Schwab’s Jim Ferraioli noted, Warsh has been critical of quantitative easing and favors balance-sheet reduction, or QT, which “effectively reduc[es] the money supply” by allowing assets to roll off without reinvestment. That prospect is particularly relevant for crypto, which has historically been highly sensitive to liquidity conditions.

At the same time, the Fed has only recently begun expanding its balance sheet again, and any abrupt reversal would represent a meaningful tightening relative to recent months. This tension between potential rate cuts and tighter balance-sheet policy is what markets are struggling to reconcile.

For crypto, the implications are twofold. In the short term, heightened sensitivity to macro and policy uncertainty means volatility remains elevated, especially if liquidity conditions worsen. Over the medium term, however, the forced unwind of leverage and extreme fear readings often occur closer to inflection points than mid-cycle pullbacks.

As one Reuters analyst observed, the current environment reflects investors “reassess[ing] their risk frameworks and how they operate in this market.” With leverage flushed and positioning reset, the next phase will hinge on policy clarity, ETF flows, and whether liquidity stabilizes or continues to tighten.

Indicia Labs does not provide investment, tax, or legal advice. You are solely responsible for determining the suitability of any investment, investment strategy, or related transaction based on your personal investment objectives, financial circumstances, and risk tolerance. Indicia Labs may offer educational information about digital assets, which may include blog posts, articles, third-party content, news feeds, tutorials, and videos. This information does not constitute any form of advice, and you should not rely on it as such. Indicia Labs does not recommend buying, earning, selling, or holding any digital asset and will not be responsible for any decisions you make based on the provided information. Any content provided by Indicia Labs may contain errors, inaccuracies, or outdated information and should not be relied upon for making any investment decisions and Indicia Labs and its affiliates hold no responsibility for the accuracy of the provided information or content.

As with any asset, the value of digital assets can fluctuate, and there is a significant risk of losing money when buying, selling, holding, or investing in digital assets. Consult your financial advisor, legal or tax professional regarding your specific situation and financial condition, and carefully consider whether trading or holding digital assets is suitable for you.

Indicia Labs is not registered with the U.S. Securities and Exchange Commission and does not offer securities services in the United States or to U.S. persons. You acknowledge that digital assets are not subject to protections or insurance provided by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation.