Sophia’s Thoughts On November’s CPI Print

November’s CPI delivered one of the largest downside surprises in years, but markets are treating the data as a signal to scrutinize, rather than a conclusion to embrace.

These are Sophia's Thoughts:

Headline and core CPI both fell sharply below expectations, marking the biggest downside inflation surprise since 2009 and reigniting the disinflation narrative.

Data disruptions from the October government shutdown raise questions about the reliability of the November CPI print.

Markets remain cautious, with muted rate-cut repricing signaling that investors are waiting for cleaner confirmation before shifting expectations.

🚀 Last week’s market performance

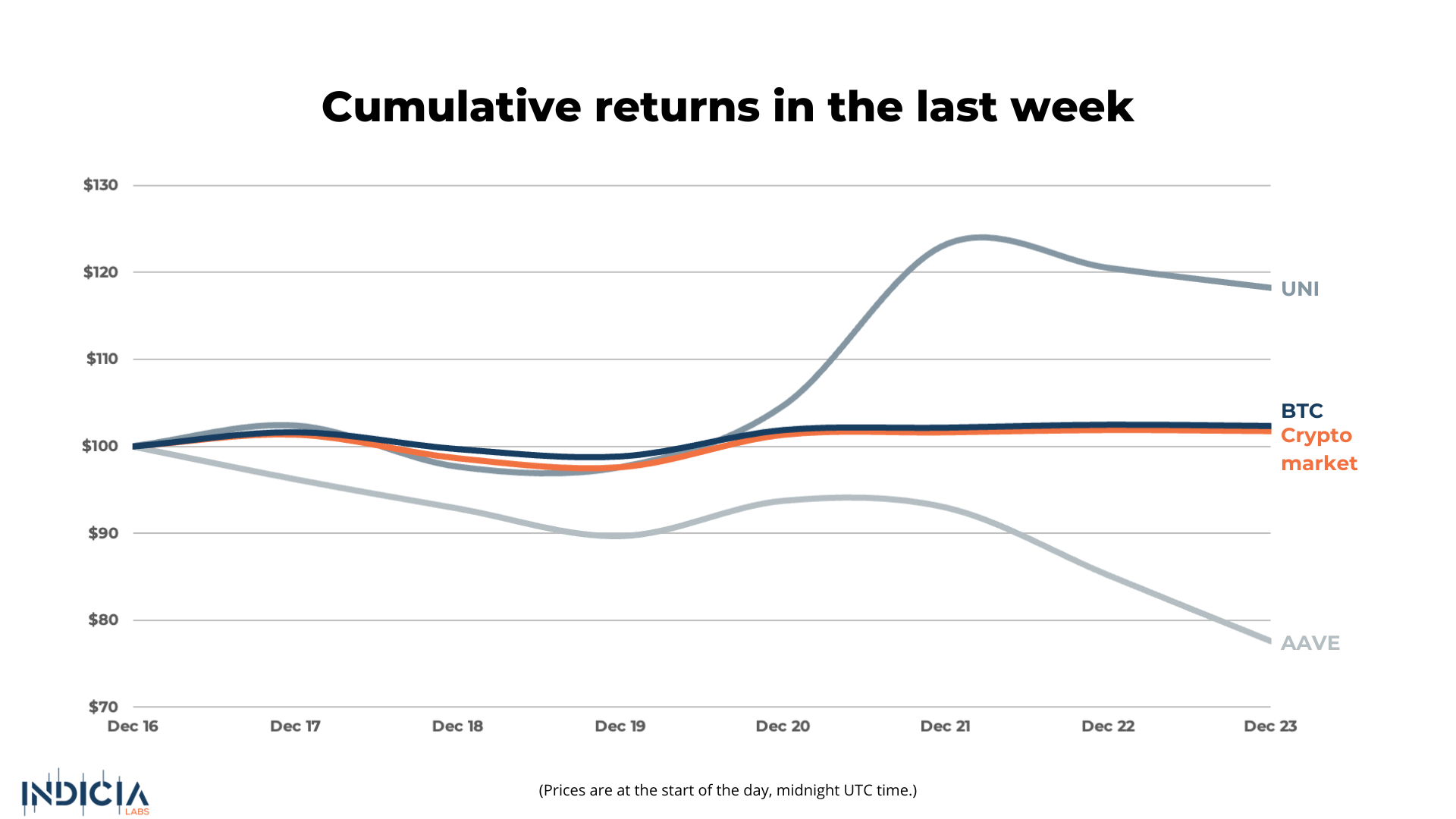

The crypto market rose 1.7% this week as risk appetite improved modestly across digital assets. Bitcoin (BTC) gained 2.4%, extending its rebound. Uniswap (UNI) was the top performer, surging 18.2%, while Aave (AAVE) lagged the market, falling –22.4% upon a governance rift over brand control.

🧐 What is your crypto mood today?

In each Sophia's Thoughts newsletter, we ask about your crypto mood. Your response to this question helps Sophia get a better sense of the pulse of crypto markets. And this ultimately translates into better insights for you when combined with Sophia's AI models. Your data empowers Sophia to provide you with even better intelligence going forward!

🔽 A CPI Print Well Below Expectations

Last week’s inflation report delivered a result that few market participants were prepared for, both in direction and in magnitude.

November CPI showed a sharp deceleration in price pressures, with headline CPI falling from 3.0% to 2.7% year-over-year, well below the 3.1% consensus estimate. Core CPI, which excludes food and energy and is closely watched by the Federal Reserve, declined from 3.0% to 2.6%, undershooting expectations of 3.0% and reaching its lowest level in several years.

What made the report particularly notable was not just the decline, but the scale of the surprise. Core CPI came in below every forecast submitted to Bloomberg’s survey of economists, marking the largest downside inflation surprise since 2009. Historically, surprises of this magnitude have meaningfully shifted market expectations around monetary policy, financial conditions, and risk assets.

Under normal circumstances, such a report would be interpreted as a decisive signal that inflation is falling faster than anticipated. That would typically support a more accommodative policy outlook, raise confidence in future rate cuts, and ease pressure on interest-sensitive assets. However, markets were quick to recognize that this data point did not arrive under normal circumstances, and the surrounding context has become central to its interpretation.

⁉️ Why the CPI Data Is Being Questioned

The November CPI print comes with a substantial caveat: data integrity concerns stemming from the October government shutdown.

The shutdown disrupted the Bureau of Labor Statistics’ ability to collect price data, forcing the agency to skip the October CPI report entirely. As a result, the November release lacked a clean month-to-month comparison and relied on incomplete data series, raising questions about how accurately it reflects underlying inflation trends.

Federal Reserve Chair Jerome Powell acknowledged these concerns, stating that the November CPI data “may be distorted.” Economists echoed that caution, noting that such an abrupt drop across multiple categories is historically rare outside of recessions. Several analysts emphasized that while the data should not be dismissed outright, it also should not be treated as definitive evidence that inflation has been fully tamed.

At the same time, there are credible signs that disinflationary pressures are building beyond this single data point. Market-based measures of inflation expectations have been moving lower in recent months. One-year inflation swaps, which reflect investors’ expectations for average inflation over the next year, have declined sharply, falling from approximately 3.5% in September to around 2.2% today.

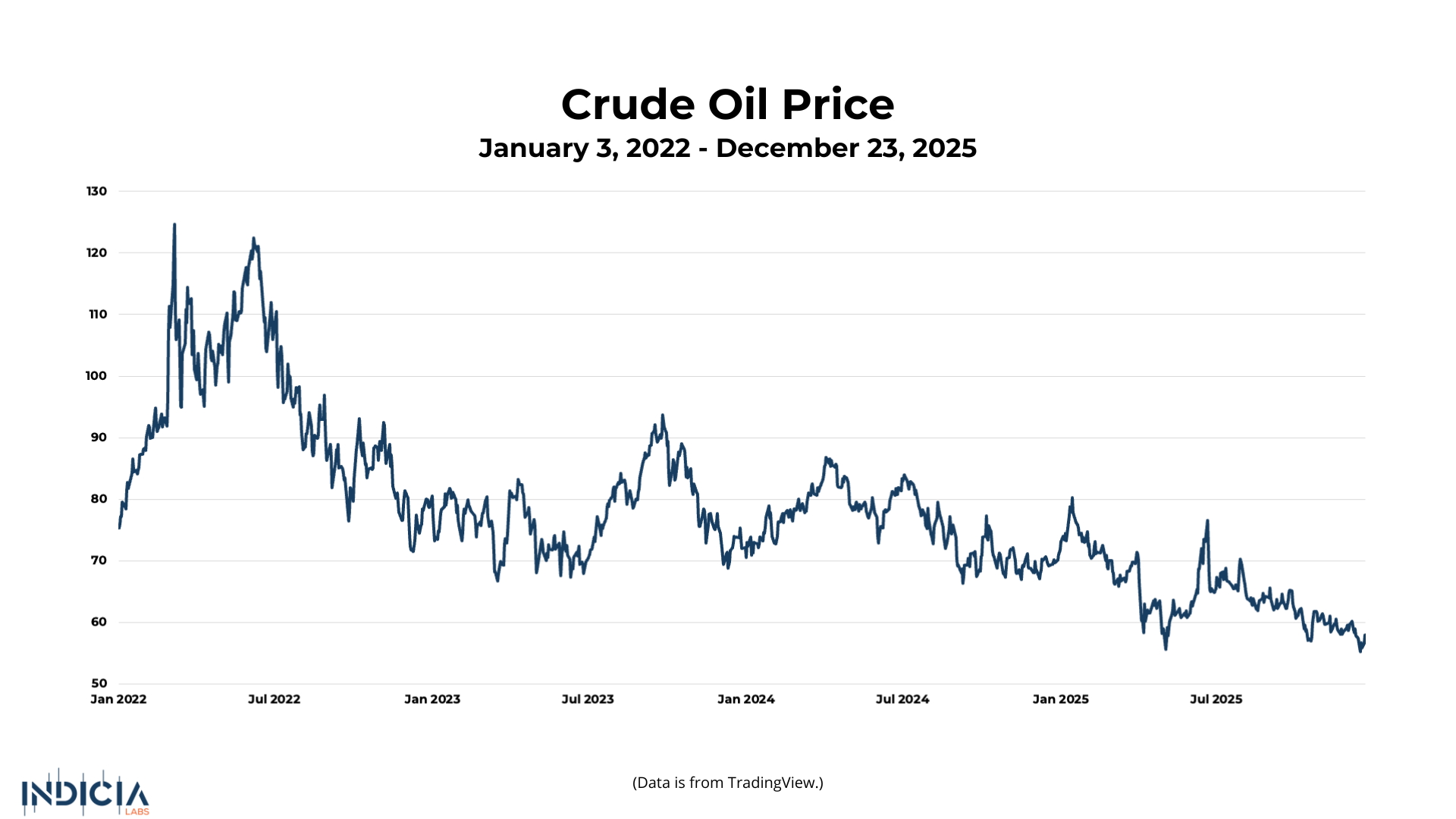

Energy prices provide another supporting signal. Crude oil prices have continued to trend lower, and energy remains a key input cost across transportation, manufacturing, and logistics. Historically, oil prices have shown a strong correlation with headline CPI, and sustained declines in energy costs tend to feed through to broader inflation measures over time.

Taken together, these signals suggest that while the November CPI print may have exaggerated the pace of disinflation, it likely captured a real directional shift rather than a complete statistical anomaly.

⚠️ Markets Remain Cautious

Despite the unusually soft CPI report, market reactions have been restrained. Expectations for Federal Reserve rate cuts in 2026 barely moved following the release, and asset markets did not respond in the way typically associated with a decisive disinflation signal. This muted response reflects a degree of skepticism: investors appear unwilling to reprice the policy outlook based on a single report with known data limitations.

In effect, markets are distinguishing between direction and confidence. While the direction of inflation may be improving, confidence in the precision of the November data remains low. Without confirmation, traders and policymakers alike appear reluctant to treat the report as a turning point.

This dynamic places greater importance on upcoming inflation data. The December CPI report, scheduled for release on January 13, will be the first to reflect a full data-collection cycle following the shutdown. As such, it is likely to carry significantly more weight in shaping expectations for monetary policy in 2026.

For now, the prevailing market stance is measured and cautious. The November CPI report provided a strong disinflationary signal, but not a conclusive one. Until cleaner data confirms the trend, skepticism remains the dominant posture, and markets appear content to wait for clarity rather than chase a potentially distorted narrative.

Indicia Labs does not provide investment, tax, or legal advice. You are solely responsible for determining the suitability of any investment, investment strategy, or related transaction based on your personal investment objectives, financial circumstances, and risk tolerance. Indicia Labs may offer educational information about digital assets, which may include blog posts, articles, third-party content, news feeds, tutorials, and videos. This information does not constitute any form of advice, and you should not rely on it as such. Indicia Labs does not recommend buying, earning, selling, or holding any digital asset and will not be responsible for any decisions you make based on the provided information. Any content provided by Indicia Labs may contain errors, inaccuracies, or outdated information and should not be relied upon for making any investment decisions and Indicia Labs and its affiliates hold no responsibility for the accuracy of the provided information or content.

As with any asset, the value of digital assets can fluctuate, and there is a significant risk of losing money when buying, selling, holding, or investing in digital assets. Consult your financial advisor, legal or tax professional regarding your specific situation and financial condition, and carefully consider whether trading or holding digital assets is suitable for you.

Indicia Labs is not registered with the U.S. Securities and Exchange Commission and does not offer securities services in the United States or to U.S. persons. You acknowledge that digital assets are not subject to protections or insurance provided by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation.