Sophia’s Thoughts On Venezuela and Bitcoin’s Utility

Bitcoin climbed back above USD 94,000, as markets digested the U.S. capture of Venezuelan President Nicolas Maduro. What are the market implications of this geopolitical shakeup?

These are Sophia's Thoughts:

Markets treated the U.S. capture of Nicolás Maduro as a geopolitical event, with Bitcoin responding to pressure and uncertainty while broader risk assets remained muted.

Venezuela’s long history of sanctions and capital controls highlights why Bitcoin and stablecoins gain traction when access to traditional financial rails is constrained.

Speculation around Venezuelan Bitcoin holdings matters less for liquidation risk and more for what it reveals about the opacity and resilience of sovereign crypto exposure.

🚀 Last week’s market performance

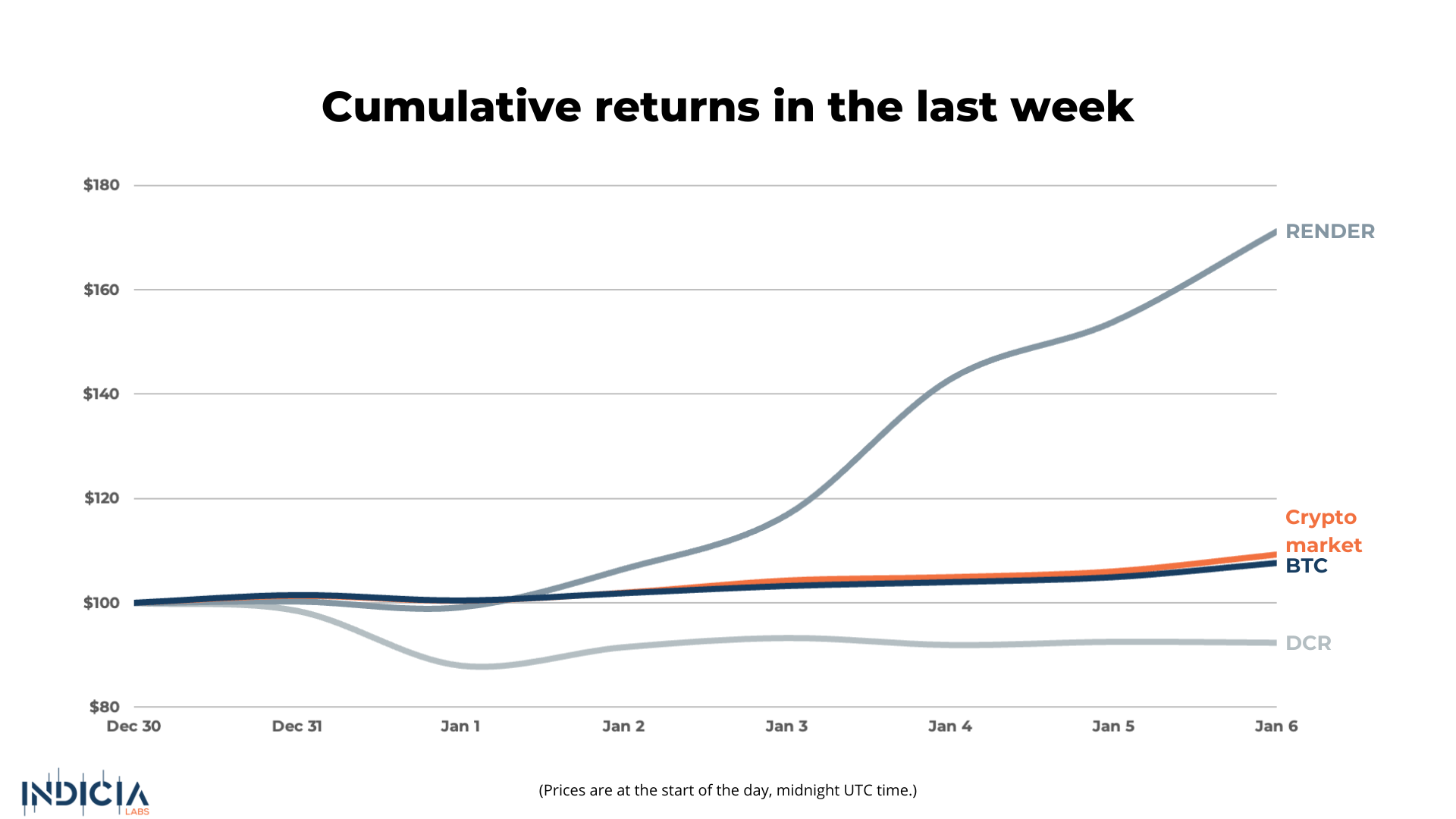

The crypto market rose 9.2% this week as risk appetite improved across digital assets. Bitcoin (BTC) gained 7.7%, extending its recent rebound. Render (RNDR) led the market, surging 71.1% amid renewed AI-narrative enthusiasm, while Decred (DCR) lagged, falling –7.7% over the period.

🧐 What is your crypto mood today?

In each Sophia's Thoughts newsletter, we ask about your crypto mood. Your response to this question helps Sophia get a better sense of the pulse of crypto markets. And this ultimately translates into better insights for you when combined with Sophia's AI models. Your data empowers Sophia to provide you with even better intelligence going forward!

😮 A Geopolitical Shock, Not a Risk-On Rally

Bitcoin climbed back above USD 94,000 this week, reaching levels last seen in early December, as markets digested a geopolitical shock few expected: the U.S. capture of Venezuelan President Nicolás Maduro. The rebound followed confirmation that U.S. forces detained Maduro and transferred him to New York to face federal charges. Crypto-linked equities moved higher alongside the asset itself, while oil stocks rallied on speculation that U.S. energy firms could benefit from a potential reopening of Venezuela’s oil sector under a post-Maduro political framework.

The broader market response, however, did not resemble a risk-on shift. Oil prices were largely unchanged, equities did not move in a coordinated fashion, and credit markets showed little reaction. The event was geopolitical in nature, but markets did not price it as an immediate macro or growth catalyst.

As Dean Chen, a Bitunix analyst, noted, “Escalating pressure without direct military conflict is supportive of Bitcoin, reinforcing its appeal as a decentralized asset amid geopolitical uncertainty.” That distinction matters. Markets were responding to pressure, not optimism.

The renewed focus on Venezuela has also resurfaced a longer-running market question: the role digital assets play in sanctioned economies operating outside the global financial system. Venezuela has spent years cut off from traditional banking rails, and experts broadly agree that cryptocurrencies, particularly Bitcoin and stablecoins, have been used as tools to store and transfer value under those constraints. While estimates of state-held Bitcoin vary widely and remain unverified, the uncertainty itself is instructive. The opacity around sovereign and quasi-sovereign crypto exposure underscores how difficult these assets are to monitor, seize, or fully control once they exist outside the formal system.

⚒️ Venezuela as a Case Study in Crypto’s Real-World Utility

Venezuela offers a clear example of why crypto demand emerges under sanctions and capital controls. The country’s oil-dependent economy has spent years navigating restricted access to global banking, chronic currency instability, and tightening sanctions.

As Chen explained, “For an economy like Venezuela’s, which is heavily dependent on oil exports, locking up energy exports effectively locks up foreign exchange inflows.” He added that “historically, every episode of intensified sanctions, SWIFT restrictions or tighter capital controls has been accompanied by rising real-world demand for Bitcoin in affected regions.”

That pattern has played out locally. Venezuela ranks among the top crypto adopters in Latin America, logging nearly USD 45 billion in transaction volume over the past year. Its state oil company reportedly increased its use of dollar-pegged stablecoins after sanctions were reimposed, while businesses and citizens turned to crypto to bypass capital controls and hedge against the bolívar’s collapse.

⚠️ Reserve Rumors, Symbolism, and the Market Takeaway

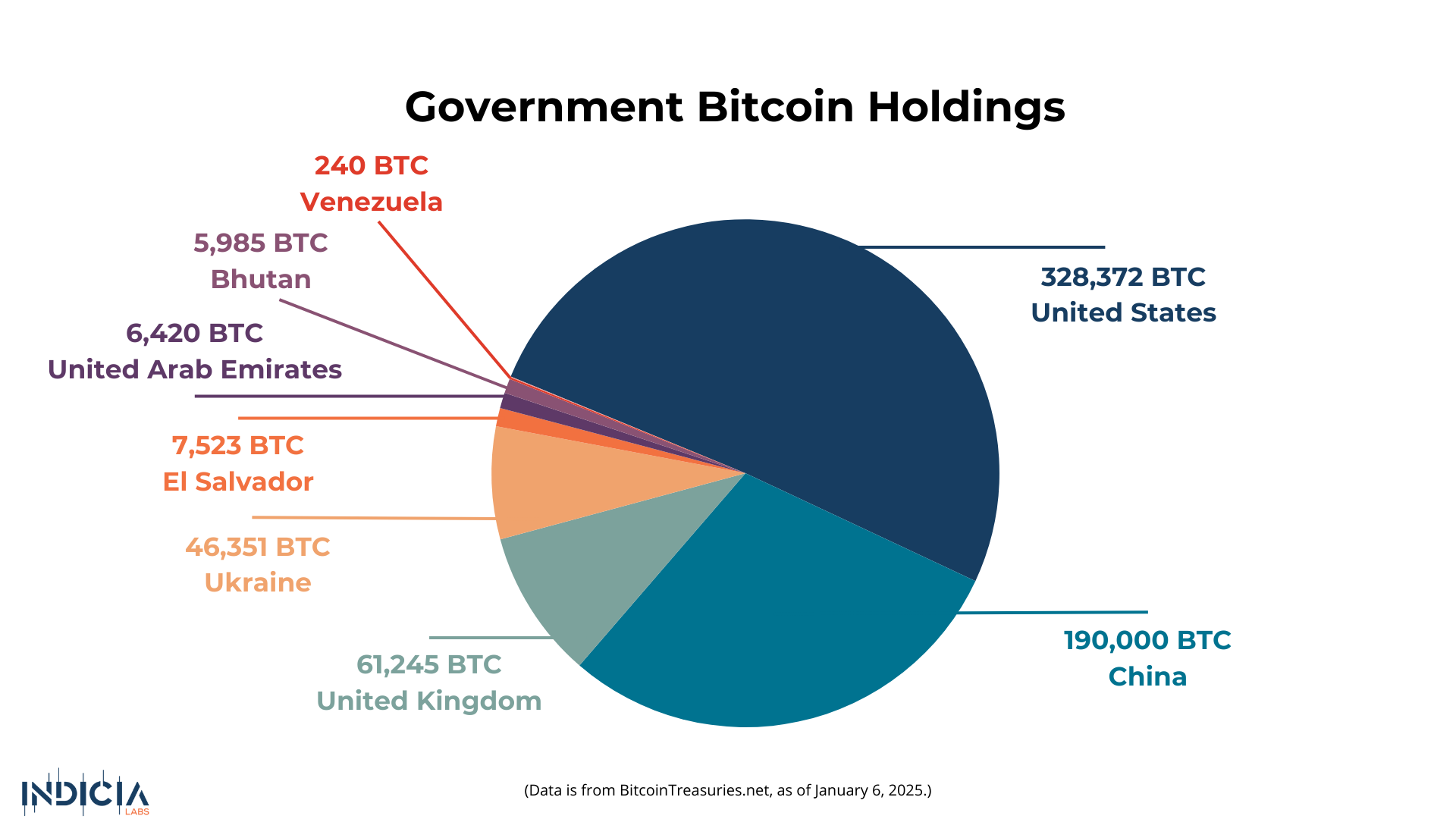

Maduro’s arrest reignited speculation that Venezuela may hold a large, undisclosed Bitcoin reserve, claims ranging from a few hundred BTC to as much as 600,000 BTC. The higher estimates are based on gold-sale math rather than on-chain evidence, and most treasury trackers currently attribute roughly 240 BTC to the Venezuelan state.

Skepticism remains widespread. “If they actually possessed 600,000 Bitcoin, then they managed to fool a lot of blockchain analysts,” said Whale Alert co-founder Frank Weert, adding, “They need to come with some serious proof for such a claim.” Ledn co-founder Mauricio Di Bartolomeo was even more direct: “I don’t believe the Venezuelan regime holds a massive secret stash of Bitcoin.” BitcoinTreasuries.net is a reputable Bitcoin holding tracker and shows that Venezuela's holdings are a mere fraction of the reported 600,000.

Even if state-linked wallets were identified, the market impact would likely be limited. Any such holdings would face legal seizure or freezing rather than immediate liquidation, reducing circulating supply instead of adding sell pressure. As Chen put it, Maduro’s arrest was a “symbolic trigger” for Bitcoin prices.

Indicia Labs does not provide investment, tax, or legal advice. You are solely responsible for determining the suitability of any investment, investment strategy, or related transaction based on your personal investment objectives, financial circumstances, and risk tolerance. Indicia Labs may offer educational information about digital assets, which may include blog posts, articles, third-party content, news feeds, tutorials, and videos. This information does not constitute any form of advice, and you should not rely on it as such. Indicia Labs does not recommend buying, earning, selling, or holding any digital asset and will not be responsible for any decisions you make based on the provided information. Any content provided by Indicia Labs may contain errors, inaccuracies, or outdated information and should not be relied upon for making any investment decisions and Indicia Labs and its affiliates hold no responsibility for the accuracy of the provided information or content.

As with any asset, the value of digital assets can fluctuate, and there is a significant risk of losing money when buying, selling, holding, or investing in digital assets. Consult your financial advisor, legal or tax professional regarding your specific situation and financial condition, and carefully consider whether trading or holding digital assets is suitable for you.

Indicia Labs is not registered with the U.S. Securities and Exchange Commission and does not offer securities services in the United States or to U.S. persons. You acknowledge that digital assets are not subject to protections or insurance provided by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation.