Sophia’s Thoughts On The Treasury Trade

Corporate Bitcoin adoption has not disappeared. Rather, it has transformed from widespread accumulation into a financing-dependent macro trade. How will this evolution shape crypto going forward?

These are Sophia's Thoughts:

The corporate Bitcoin bid still exists, but it has concentrated into a single dominant balance sheet rather than a distributed wave of adoption.

With the recent negative price action, treasuries are now showing whether they can survive long enough for price appreciation to rescue their capital structure.

The market is beginning to price treasury companies not as Bitcoin exposure, but as leveraged duration bets dependent on continued refinancing.

🚀 Last week’s market performance

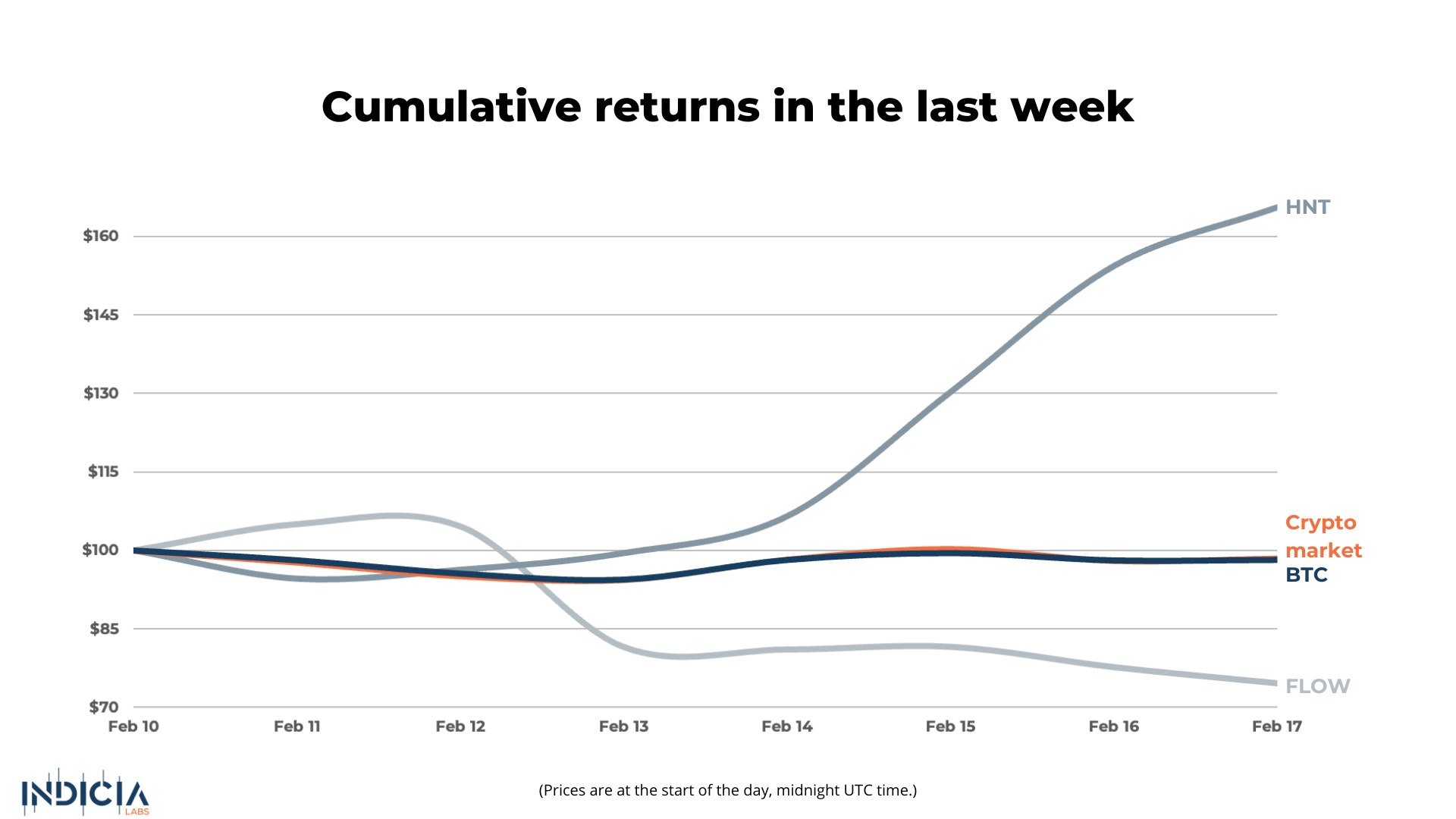

This week, the broader crypto market declined 1.5%, with Bitcoin (BTC) falling 1.8% as momentum softened. Helium (HNT) stood out, rallying 65.6% amid a sharp increase in users, while Flow (FLOW) underperformed significantly, dropping 25.3% following a security exploit.

🧐 What is your crypto mood today?

In each Sophia's Thoughts newsletter, we ask about your crypto mood. Your response to this question helps Sophia get a better sense of the pulse of crypto markets. And this ultimately translates into better insights for you when combined with Sophia's AI models. Your data empowers Sophia to provide you with even better intelligence going forward!

📃 Corporate Demand is no Longer Broad

Over the past year, one of the most important sources of Bitcoin demand has come from corporate treasury adoption. Public companies were no longer simply allocating capital, they were converting their balance sheets into long-duration Bitcoin exposure. Firms like Strategy effectively turned themselves into publicly traded Bitcoin holding vehicles, allowing investors to gain BTC exposure through traditional equities and securities that can fit inside brokerage and retirement accounts. That narrative implied a recurring structural buyer entering the market. But 2026 is revealing a different reality: demand has not disappeared, it has concentrated.

In January, public companies added roughly 43,230 BTC, about USD 3.5 billion, to their treasuries. Yet almost all of that buying came from a single firm. As Decrypt reported, “Strategy accounted for 93% of Bitcoin purchased among publicly traded firms last month.” The company alone acquired 40,150 BTC, while every other corporate treasury combined bought only 3,080 BTC. Public companies now hold around 1.13 million BTC in total, with Strategy responsible for nearly two-thirds of that amount.

This marks a structural shift. Corporate adoption still exists, but it is no longer a distributed wave of participation. A single balance sheet now anchors the majority of demand while smaller participants fade in influence. Some have already begun moving the opposite direction. Last month, Riot sold 1,363 BTC, Bitdeer 490 BTC, and Exodus sold 198 BTC. Even as more companies announce treasury strategies, their impact is shrinking. The corporate bid is becoming less an ecosystem trend and more a concentrated capital structure.

🪙The Treasury Model is Being Stress-Tested

The importance of that concentration becomes clearer when considering how the strategy works. The treasury model functioned in a rising market because companies could raise capital faster than dilution destroyed shareholder value. With prices stabilizing rather than accelerating, that equation is being tested.

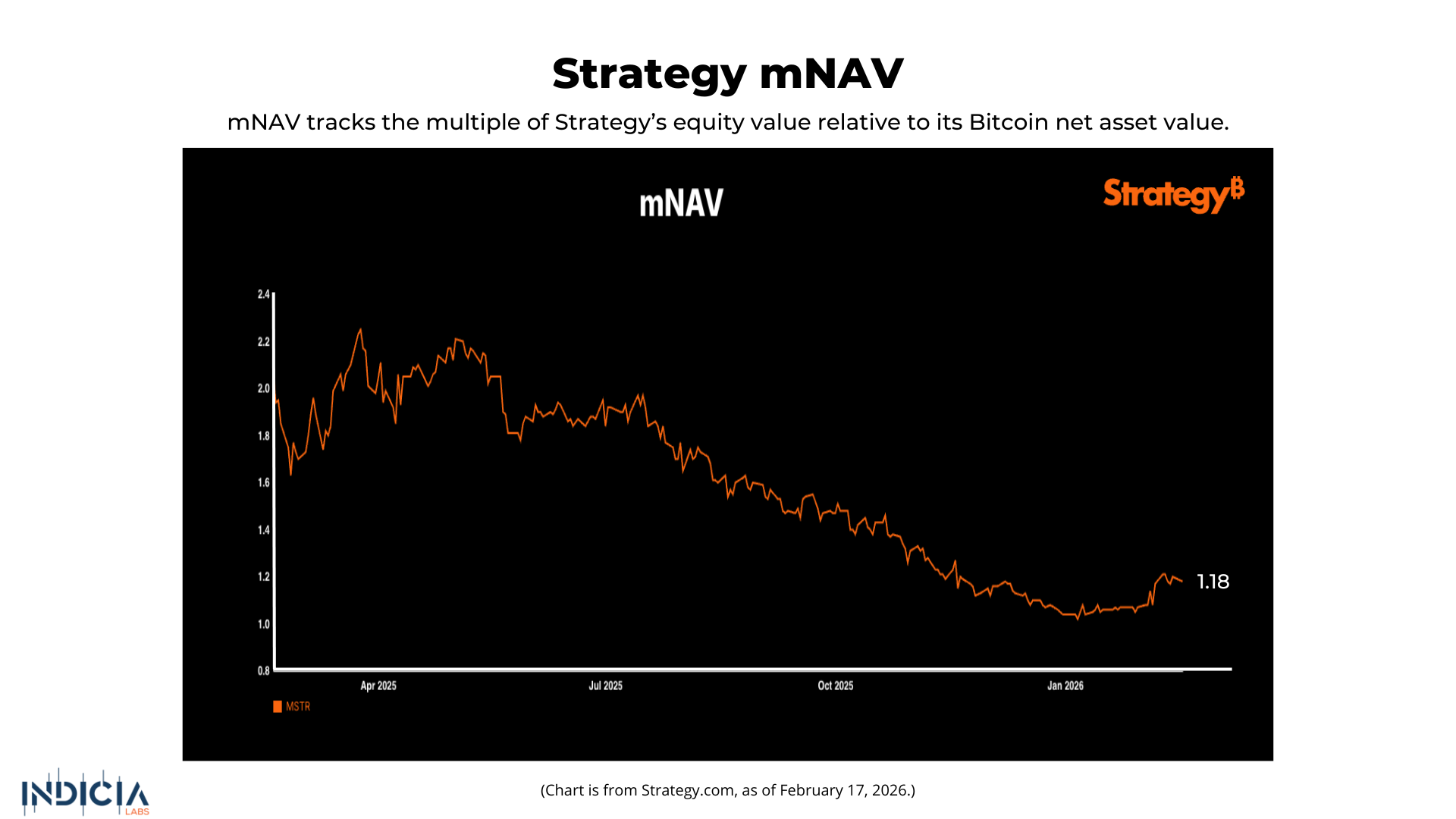

Strategy now holds over 717,000 BTC but sits billions underwater, with its holdings “about $5.7 billion” below cost and the company reporting “a 12.4 billion fourth-quarter loss.” Yet management’s response has remained unchanged. On February 10, Saylor said on CNBC’s Squawk Box that “We’ll refinance the debt. We’ll just roll it forward.” The company funds purchases through equity issuance, convertible debt, and preferred shares, including a USD 3.4 billion preferred program paying 11.25% dividends. Despite the suffering balance sheet, Saylor maintains conviction in Strategy’s playbook, stating that “I expect we’ll be buying bitcoin every quarter forever.” At present, Strategy’s mNAV (calculated by dividing Enterprise Value by the BTC Reserve) lies at 1.18.

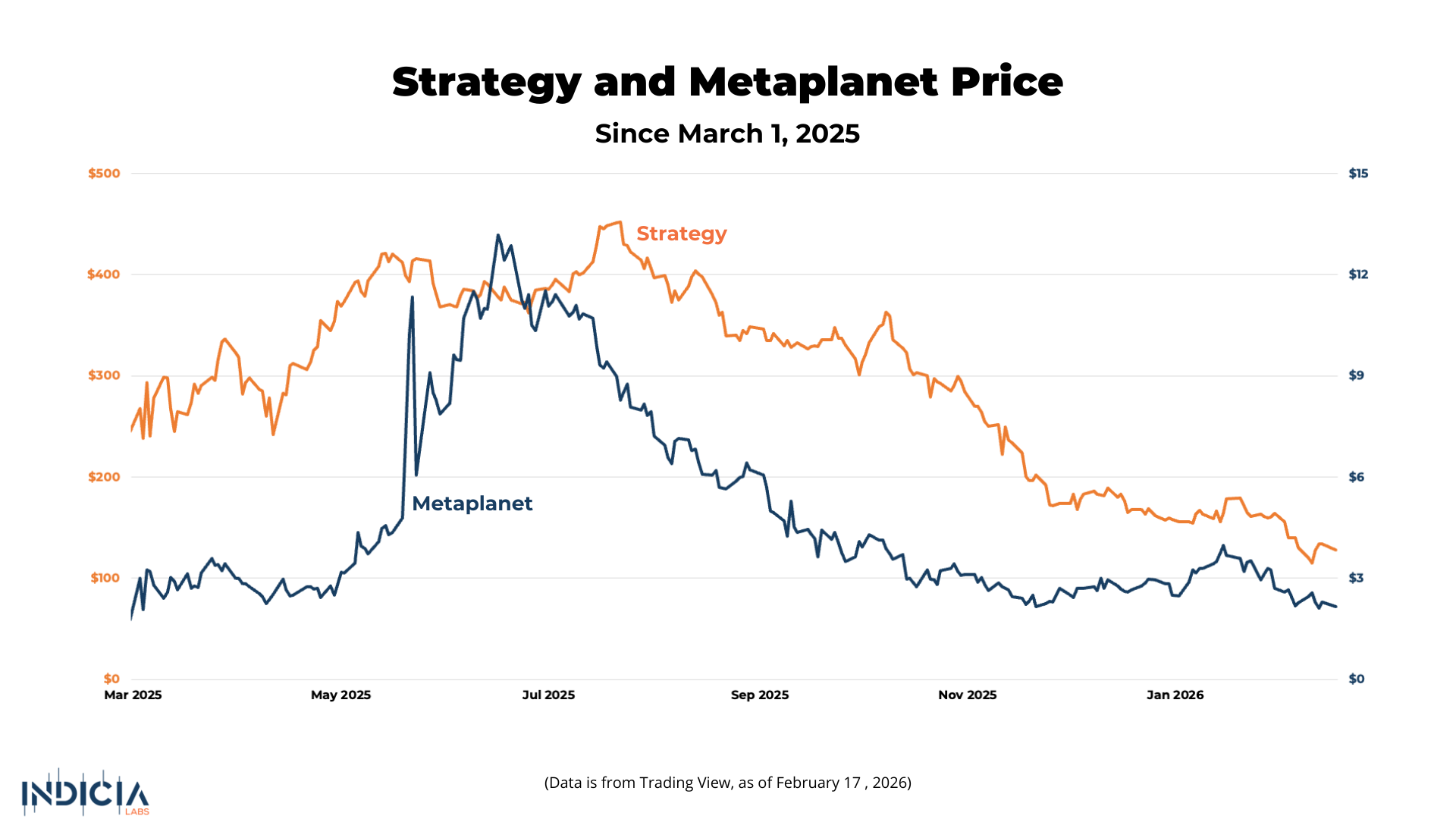

Other treasury firms are facing similar pressures, but without the same scale or financing flexibility. Japan-listed Metaplanet, for example, reported an unrealized valuation loss of roughly USD 660 million tied to Bitcoin’s year-end price even as it continues targeting 1% of total supply and aims to remain “long Bitcoin forever.” Smaller treasury firms and miners have already begun reducing holdings as prices stalled, reinforcing how dependent the model is on continued capital access rather than just long-term conviction.

This reveals what treasury companies truly represent: not simply long Bitcoin, but long time. The strategy succeeds if financing remains available long enough for appreciation to occur. Motley Fool analysts foresee that if companies cannot succeed in refinancing their debt, it may catalyze “forced selling…creating a vicious cycle.” For the first time, treasury strategies must operate without price momentum supporting them, turning the trade from reflexive growth into balance-sheet endurance.

💱A Widespread Repricing

At the same time, the competitive landscape is shifting. Corporate treasuries originally provided exposure investors could not easily obtain, but that advantage is disappearing. As the Motley Fool noted, “crypto treasury firms carry more risk than passively managed ETFs.” With expanding ETF access and potential yield-bearing structures, investors can gain Bitcoin exposure without dilution risk, leverage risk, or corporate financing risk.

This changes how the market prices these companies. They are no longer access vehicles, they are leveraged macro expressions of Bitcoin duration. Equity markets have begun reflecting this shift, with treasury stocks falling sharply even while Bitcoin remains far above prior cycle levels. The key question for 2026 is therefore not whether companies continue buying, but whether they can continue financing. If capital markets remain open, treasury buyers act as a persistent structural bid; if financing tightens, they risk becoming structural sellers.

Corporate Bitcoin adoption was never purely about belief in the asset. It was about monetizing Bitcoin exposure through capital structure. The market is now testing whether that structure works without a bull market supporting it. For the first time in the cycle, the marginal buyer of Bitcoin may depend less on conviction and more on refinancing conditions.

Indicia Labs does not provide investment, tax, or legal advice. You are solely responsible for determining the suitability of any investment, investment strategy, or related transaction based on your personal investment objectives, financial circumstances, and risk tolerance. Indicia Labs may offer educational information about digital assets, which may include blog posts, articles, third-party content, news feeds, tutorials, and videos. This information does not constitute any form of advice, and you should not rely on it as such. Indicia Labs does not recommend buying, earning, selling, or holding any digital asset and will not be responsible for any decisions you make based on the provided information. Any content provided by Indicia Labs may contain errors, inaccuracies, or outdated information and should not be relied upon for making any investment decisions and Indicia Labs and its affiliates hold no responsibility for the accuracy of the provided information or content.

As with any asset, the value of digital assets can fluctuate, and there is a significant risk of losing money when buying, selling, holding, or investing in digital assets. Consult your financial advisor, legal or tax professional regarding your specific situation and financial condition, and carefully consider whether trading or holding digital assets is suitable for you.

Indicia Labs is not registered with the U.S. Securities and Exchange Commission and does not offer securities services in the United States or to U.S. persons. You acknowledge that digital assets are not subject to protections or insurance provided by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation.