Sophia’s Thoughts On Greenland and EU Tariffs

Tariffs are back in the headlines, not as a trade policy tool, but as a geopolitical lever that markets are once again being forced to price in real time.

These are Sophia's Thoughts:

Trump’s proposed tariffs tied to Greenland have revived U.S.–Europe trade tensions, triggering a risk-off reaction across global markets despite limited direct economic damage.

Europe is signaling resistance through rhetoric and potential retaliation, but the real escalation risk lies in whether the dispute spills from tariffs into capital markets.

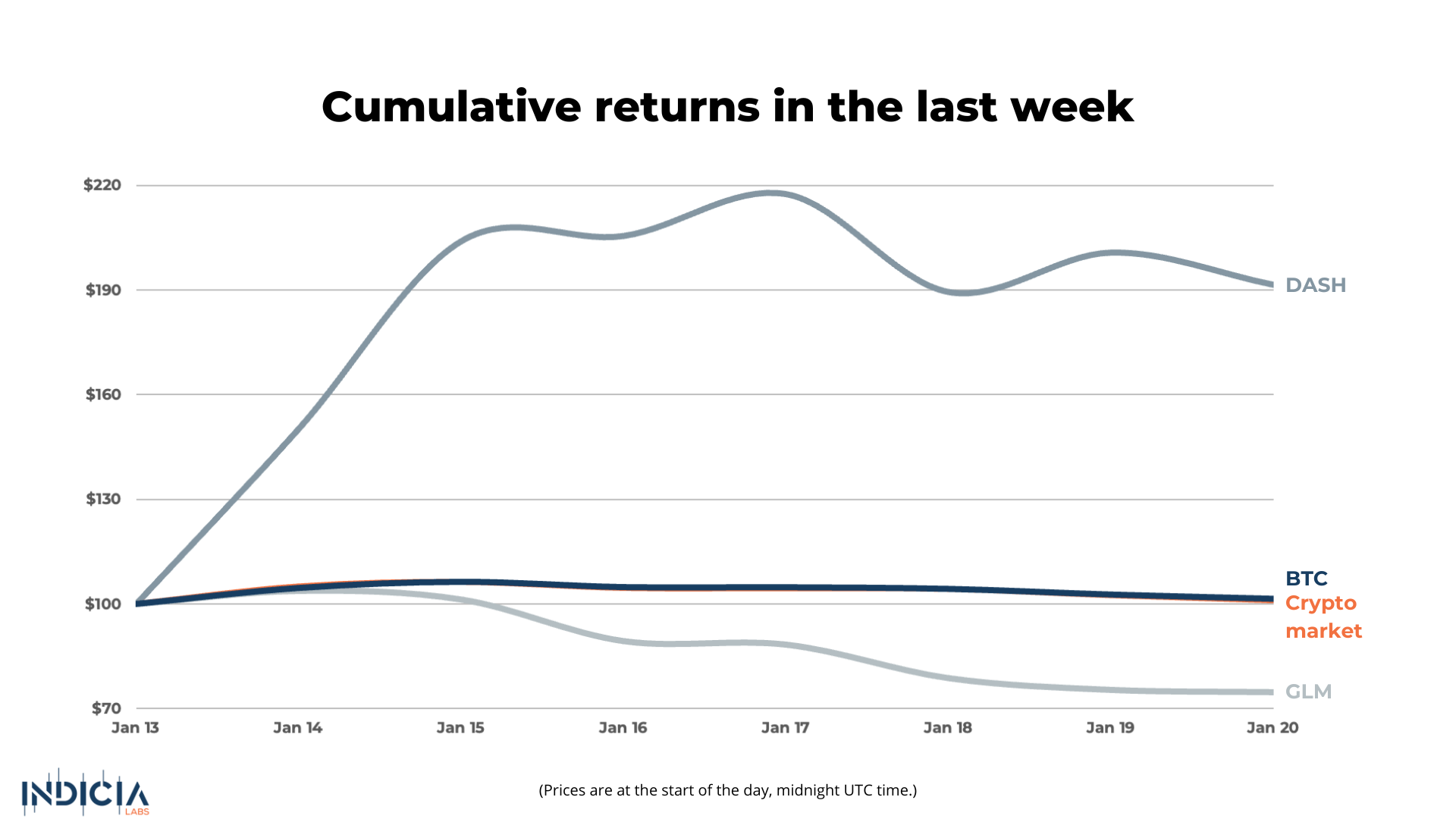

Crypto reacted immediately as leverage unwound, reinforcing that in geopolitical shocks Bitcoin trades liquidity first, even as longer-term uncertainty strengthens the case for non-sovereign assets.

🚀 Last week’s market performance

In each Sophia's Thoughts newsletter, we ask about your crypto mood. Your response to this question helps Sophia get a better sense of the pulse of crypto markets. And this ultimately translates into better insights for you when combined with Sophia's AI models. Your data empowers Sophia to provide you with even better intelligence going forward!

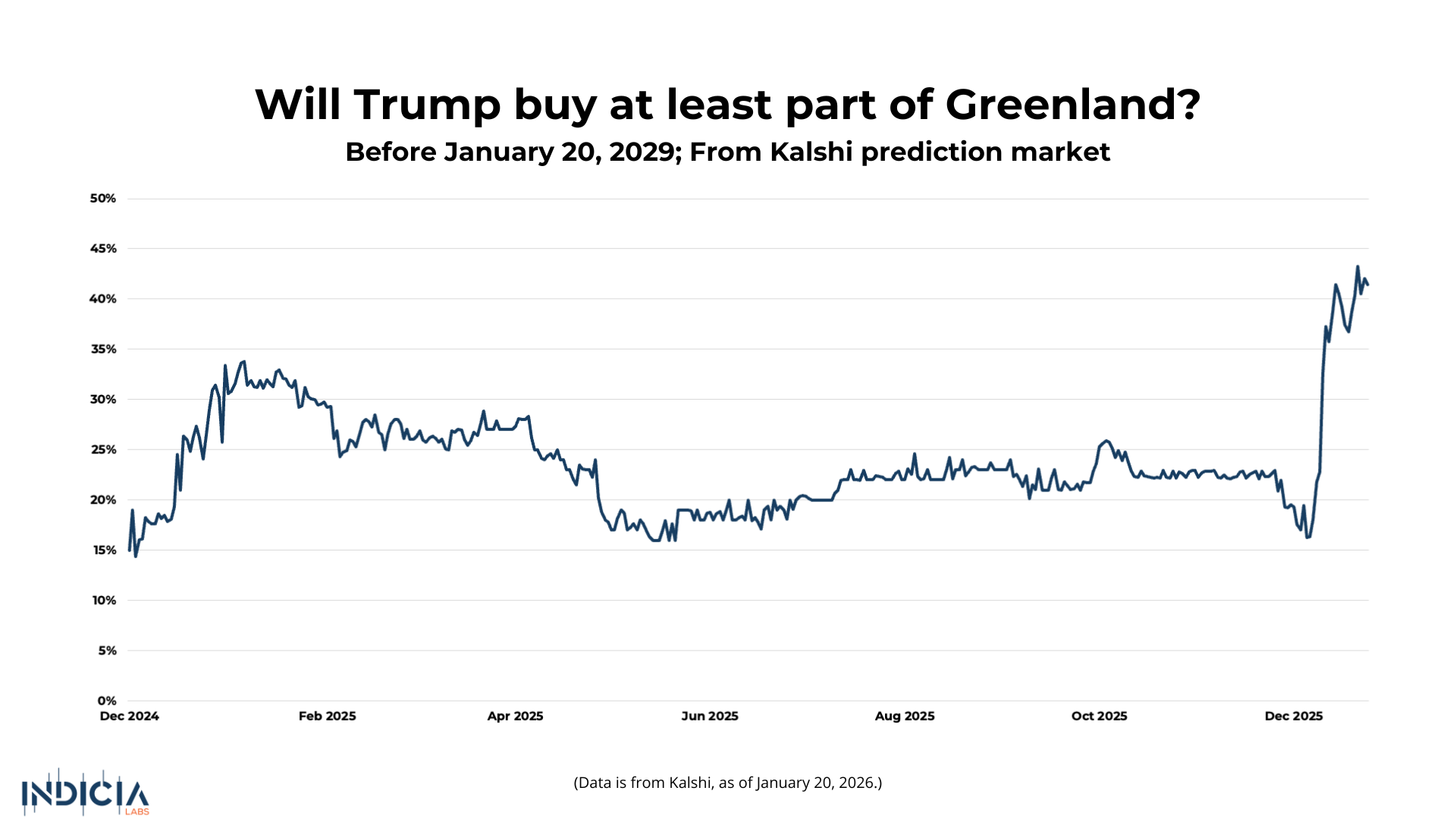

🌍 Tariffs, Greenland, and Geopolitical Risk

Tariffs are back in the headlines, and once again they are reshaping market behavior far beyond their direct economic impact. Over the weekend, President Donald Trump announced that the United States will impose a 10% tariff on imports from eight European countries starting February 1, with the rate set to rise to 25% by June 1 unless progress is made toward a deal involving Greenland. The announcement immediately revived fears of a renewed U.S.–Europe trade conflict and injected fresh geopolitical uncertainty into global markets.

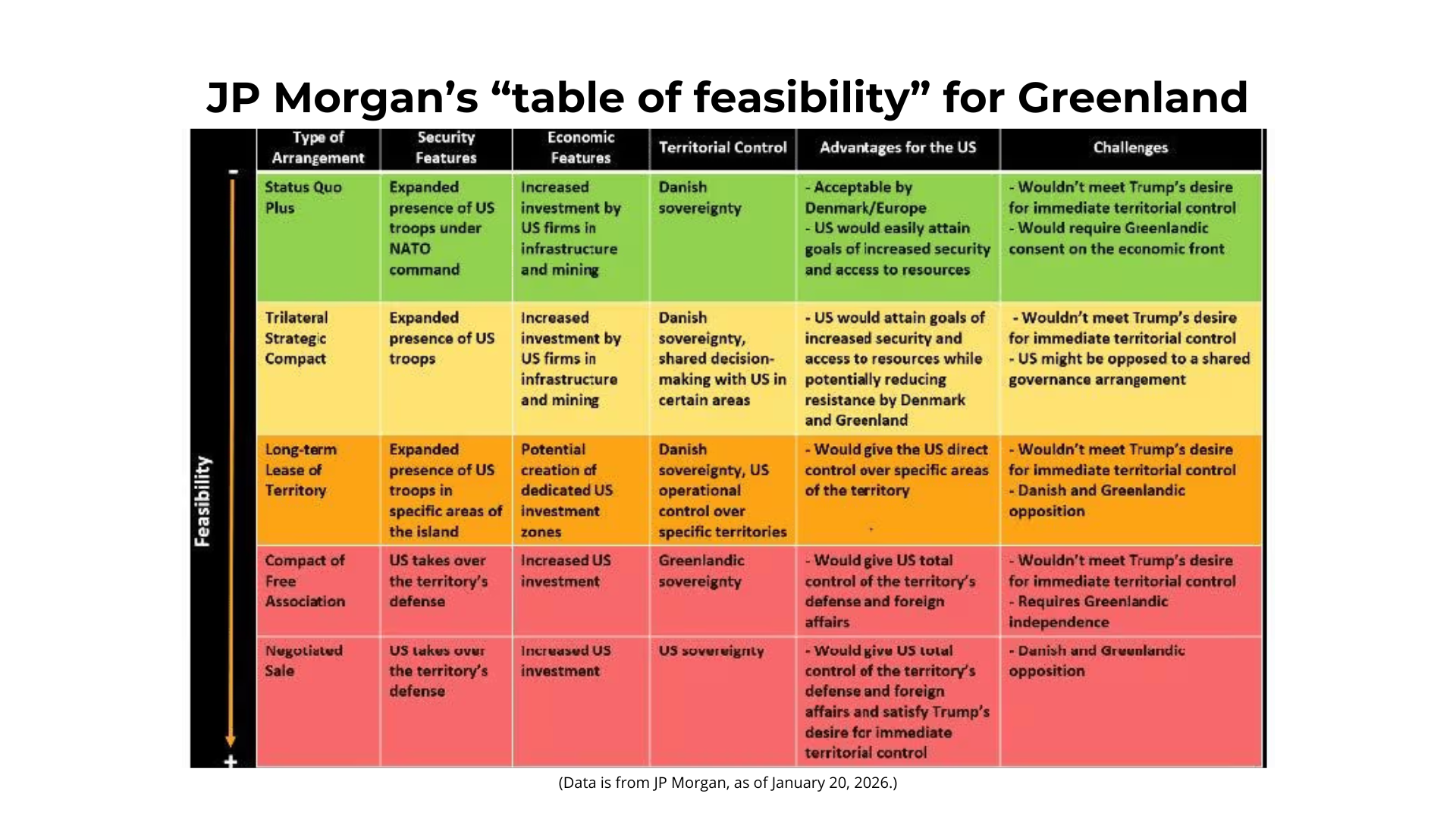

Unlike prior tariff episodes, this dispute is not centered on trade imbalances or domestic industry protection. It is explicitly geopolitical. Trump has framed Greenland as essential to U.S. national security, pointing to Arctic defense, missile detection, and access to critical minerals. European leaders have rejected that premise outright. Speaking at the World Economic Forum Davos conference, European Commission President Ursula von der Leyen stressed that commitments still matter, saying that “in politics as in business, a deal is a deal, and when friends shake hands, it must mean something.”

Markets responded swiftly. U.S. equity futures fell, European stocks dropped sharply, gold rallied to record highs, and Bitcoin sold off as investors moved into a risk-off posture. The reaction was not driven by expectations of severe economic damage from the tariffs themselves, but by the reintroduction of tariffs as a negotiating weapon and the renewed uncertainty around global trade relations.

🧨 Europe’s Response

European leaders moved quickly to condemn the tariffs and signal potential retaliation, though consensus on how far to go remains fragile.

France has taken the hardest line so far. President Emmanuel Macron warned that Europe may need to deploy its Anti-Coercion Instrument. Often referred to as the EU’s “trade bazooka,” it is a framework that allows the bloc to impose coordinated tariffs, trade restrictions, or investment limits in response to economic pressure from foreign governments. Macaron argued in Davos that it is “a powerful instrument” and that Europe “should not hesitate to deploy it in today’s tough environment.”

Others have urged restraint. German Chancellor Friedrich Merz has pushed to tone down rhetoric, while UK Prime Minister Keir Starmer ruled out tit-for-tat threats and instead called for “calm discussions between allies.” That split highlights Europe’s core dilemma: projecting resolve without triggering an uncontrollable escalation.

Several market strategists believe Europe lacks both the appetite and the capacity for a prolonged trade war with the United States. Christopher Dembik of Pictet Asset Management summed up that view in a note, writing that Europe “doesn’t have the means to wage a full-blown trade war with the U.S.” and that he therefore does not expect major escalation.

The more serious risk lies beyond tariffs themselves. Deutsche Bank has warned that escalation could shift from trade flows to capital flows, a far more destabilizing outcome for global markets. George Saravelos, Deutsche Bank’s global head of FX research, cautioned that the true danger is whether “the EU decides to activate its anti-coercion instrument by putting measures that impact capital markets on the table” which would be the most disruptive to markets. Tariffs shave growth at the margins, but capital-market retaliation could directly impact interest rates, liquidity, and the global cost of capital.

₿ Why This Matters for Crypto

Crypto markets absorbed the shock immediately. Bitcoin and major altcoins sold off sharply as the tariff headlines broke, triggering widespread liquidations during thin liquidity conditions. This was not a crypto-specific breakdown. It was a macro shock, and crypto once again acted as one of the fastest pressure valves in the system. According to Cryptonews, Trump’s tariff threats over Greenland triggered USD 875 million in crypto liquidations within 24 hours, as traders rapidly cut risk exposure.

Analysts were quick to note that fundamentals were not the driver. Ryan Lee, chief analyst at Bitget, told Decrypt that the pullback was being driven “less by crypto-specific fundamentals and more by a broader shift in global risk sentiment.”

In moments like this, crypto moves first. Leverage unwinds, volatility spikes, and correlations with traditional risk assets rise, particularly when shocks arrive outside normal U.S. trading hours. But episodes like this also reopen a familiar debate: whether Bitcoin functions primarily as a geopolitical hedge or as a liquidity barometer.

In the short term, it behaves like the latter. Over longer horizons, however, repeated bouts of tariff brinkmanship, politicized trade, and institutional uncertainty reinforce the appeal of neutral, non-sovereign assets, especially if confidence in traditional frameworks continues to erode.

For now, the base case remains de-escalation. A JPMorgan International Market Intelligence note framed the situation succinctly, observing that Trump “creates noise and throws in a maximal stance designed to trigger negotiation and create leverage,” while concluding that “the most likely outcome remains a negotiated arrangement.”

If that pattern holds, volatility should fade as talks progress, potentially as soon as this week in Davos. If it does not, and rhetoric hardens into action, markets may need to brace for Liberation Day-style drawdowns before any longer-term narrative reasserts itself.

Indicia Labs does not provide investment, tax, or legal advice. You are solely responsible for determining the suitability of any investment, investment strategy, or related transaction based on your personal investment objectives, financial circumstances, and risk tolerance. Indicia Labs may offer educational information about digital assets, which may include blog posts, articles, third-party content, news feeds, tutorials, and videos. This information does not constitute any form of advice, and you should not rely on it as such. Indicia Labs does not recommend buying, earning, selling, or holding any digital asset and will not be responsible for any decisions you make based on the provided information. Any content provided by Indicia Labs may contain errors, inaccuracies, or outdated information and should not be relied upon for making any investment decisions and Indicia Labs and its affiliates hold no responsibility for the accuracy of the provided information or content.

As with any asset, the value of digital assets can fluctuate, and there is a significant risk of losing money when buying, selling, holding, or investing in digital assets. Consult your financial advisor, legal or tax professional regarding your specific situation and financial condition, and carefully consider whether trading or holding digital assets is suitable for you.

Indicia Labs is not registered with the U.S. Securities and Exchange Commission and does not offer securities services in the United States or to U.S. persons. You acknowledge that digital assets are not subject to protections or insurance provided by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation.