Sophia’s Thoughts On Trump and Powell

A criminal probe into Jerome Powell has turned a long-running rate dispute into a high-stakes test of Federal Reserve independence.

These are Sophia's Thoughts:

The Trump–Powell conflict escalated after the DOJ issued subpoenas tied to the Fed’s headquarters renovation, with Powell framing the investigation not as a budget dispute but as retaliation for resisting political pressure on interest rates.

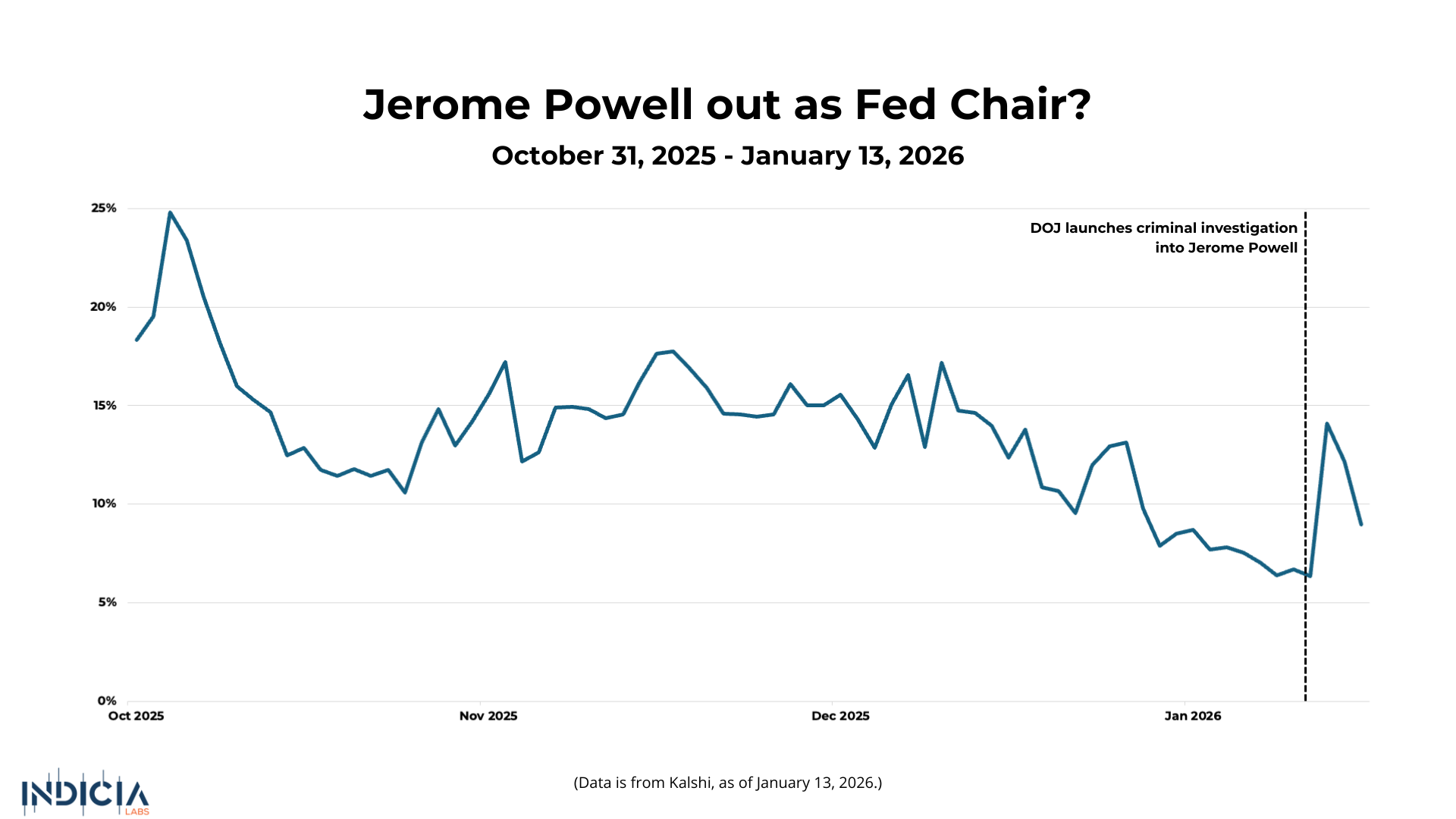

Unified pushback from former Fed chairs and growing congressional resistance has reframed the probe as a challenge to central bank independence, now reflected in prediction markets reassessing Powell’s tenure.

Markets are responding less to near-term rate implications and more to the precedent being set, treating the showdown as a slow-burn institutional risk rather than an immediate catalyst for policy shifts.

🚀 Last week’s market performance

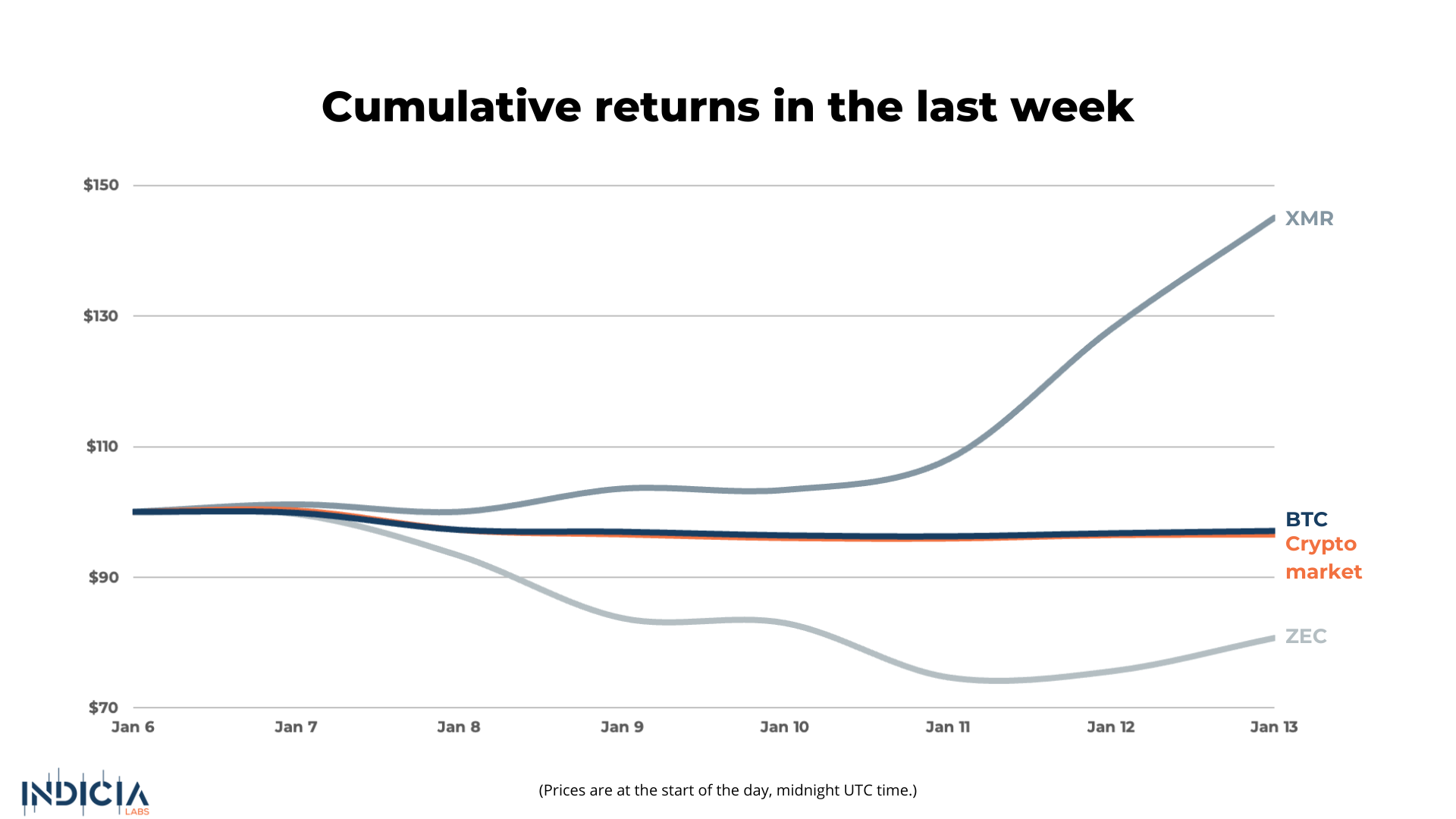

This week, the broader crypto market declined 3.5%, with Bitcoin (BTC) falling 2.9%. Monero (XMR) stood out, rallying 45.1% as demand for privacy-focused assets surged, while Zcash (ZEC) dropped 19.3% following news that its core development team had departed the company.

🧐 What is your crypto mood today?

In each Sophia's Thoughts newsletter, we ask about your crypto mood. Your response to this question helps Sophia get a better sense of the pulse of crypto markets. And this ultimately translates into better insights for you when combined with Sophia's AI models. Your data empowers Sophia to provide you with even better intelligence going forward!

💼 When Rate Pressure Turned Legal

The long-running clash between President Donald Trump and Federal Reserve Chair Jerome Powell escalated sharply this week after the Justice Department served the Federal Reserve with grand jury subpoenas tied to Powell’s congressional testimony on renovations to the Fed’s Washington headquarters.

Officially, the investigation focuses on a USD 2.5 billion refurbishment project that has run roughly USD 700 million over initial estimates. Trump has insisted the probe is unrelated to monetary policy, telling reporters it has “nothing to do with interest rates,” even as he continued attacking Powell as “either incompetent or crooked.”

Powell, who has spent years declining to engage publicly with Trump’s criticism, responded with an unusually direct video statement. While acknowledging the legal process, he framed the investigation as part of a broader campaign to pressure the Fed on rates. He warned that the subpoenas should be viewed “in the broader context of the administration’s threats and ongoing pressure,” arguing that the threat of criminal charges was not about renovation details, but rather “a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the President.”

In Powell’s telling, the investigation marked a shift from political criticism to something far more consequential: a challenge to whether monetary policy decisions would continue to be guided by economic evidence or by political intimidation.

⚔️ Fed Independence Becomes the Battleground

The administration’s justification for the probe rests on cost overruns tied to the Fed’s headquarters renovation. White House officials have portrayed the project as excessive, with Office of Management and Budget Director Russell Vought comparing it to “the building of the Palace of Versailles” and calling the spending “outrageous.”

Powell has pushed back forcefully on that characterization. In testimony before the Senate Banking Committee, he emphasized that the overruns stemmed from inflation, structural remediation, and unforeseen issues such as asbestos, not luxury upgrades. As he put it bluntly, “There’s no new marble… There are no new water features... There’s no beehives and there’s no roof garden terraces.”

What elevated the issue from a budget dispute to a systemic concern was the reaction from across the central banking community. In a show of unity, all living former Federal Reserve chairs: including Janet Yellen, Ben Bernanke, and Alan Greenspan, issued a joint statement warning that the investigation threatened the foundations of U.S. monetary credibility. They argued that using legal pressure to influence a central bank resembled practices seen in countries with weak institutions, writing that “this is how monetary policy is made in emerging markets… with highly negative consequences for inflation.” They added that "It has no place in the United States whose greatest strength is the rule of law, which is at the foundation of our economic success."

The political fallout has spilled into Congress as well. Republican Senator Thom Tillis announced he would oppose confirmation of any future Fed nominee until the matter is resolved, raising the stakes for Trump as Powell’s term as chair approaches its May expiration. Prediction markets are already reacting, with Kalshi odds showing a reassessment of Powell’s future as institutional risk enters the pricing.

At this point, the confrontation is no longer just about renovation costs, it has become a test of whether Fed independence is a binding principle or merely a norm that holds only until it conflicts with political priorities.

📜 Pricing Institutional Risk, Not Policy Change

For markets, the significance of the Trump–Powell showdown lies less in near-term rate decisions and more in what it signals about the durability of U.S. institutions. Goldman Sachs trader Rich Privorotsky argued that pressure on the Fed could push investors toward traditional hedges, warning the situation may lead to “higher long-term Treasury yields, higher gold and metal prices, and a modestly weaker dollar.” Since the investigation became public, all three trends have appeared, though only modestly, suggesting markets are taking note without panicking. In crypto, this has driven Bitcoin higher as a perceived hedge against eroding Fed independence and potential dollar debasement fears, with BTC rallying alongside gold to test USD 94,000+ levels shortly after Powell's statement, while privacy coins like Monero surged sharply on concerns over institutional oversight.

ABN Amro economist Rogier Quaedvlieg noted an additional irony: rather than forcing easier policy, political pressure could actually harden the Fed’s stance. He argued that “this challenge to the Fed’s independence could prompt the FOMC to take a slightly more hawkish stance to defend the institution,” reducing the likelihood of near-term rate cuts. For crypto, a more hawkish Fed risks delaying liquidity boosts that fuel rallies, though persistent political pressure could still amplify BTC's narrative as a non-sovereign alternative amid credibility shocks.

Bloomberg Economics outlined the longer-term danger if political control over monetary policy were to take hold. In their assessment, politicians face a strong temptation to stimulate growth ahead of elections and “enjoy the benefits of higher employment and growth now, and deal with the soaring inflation and painful corrections later,” a scenario in which “everyone other than the meddling politician is worse off.”

In the broader context, markets already understand the likely trajectory: Powell’s term ends in May, Trump wants lower rates, and a more dovish successor is likely regardless of this investigation. That reality helps explain why market reactions have remained contained.

Indicia Labs does not provide investment, tax, or legal advice. You are solely responsible for determining the suitability of any investment, investment strategy, or related transaction based on your personal investment objectives, financial circumstances, and risk tolerance. Indicia Labs may offer educational information about digital assets, which may include blog posts, articles, third-party content, news feeds, tutorials, and videos. This information does not constitute any form of advice, and you should not rely on it as such. Indicia Labs does not recommend buying, earning, selling, or holding any digital asset and will not be responsible for any decisions you make based on the provided information. Any content provided by Indicia Labs may contain errors, inaccuracies, or outdated information and should not be relied upon for making any investment decisions and Indicia Labs and its affiliates hold no responsibility for the accuracy of the provided information or content.

As with any asset, the value of digital assets can fluctuate, and there is a significant risk of losing money when buying, selling, holding, or investing in digital assets. Consult your financial advisor, legal or tax professional regarding your specific situation and financial condition, and carefully consider whether trading or holding digital assets is suitable for you.

Indicia Labs is not registered with the U.S. Securities and Exchange Commission and does not offer securities services in the United States or to U.S. persons. You acknowledge that digital assets are not subject to protections or insurance provided by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation.